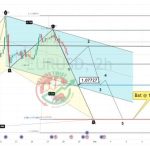

GBPUSD Chart Technical Outlook points to more losses toward 1.2620

GBP/USD trades inside a bearish corrective channel, developing an extended WXY structure. The primary trend remains bullish. Prices have retreated lower from the channel resistance. It could correct toward the 50% Fibo level that overlaps the daily ATR and the previous week’s POC at 1.2620. If prices continue for the downside, this could be an extended five-wave corrective structure with deeper projections – strong PCE data would be needed.

I expected an immediate downside price action toward 1.2620, but the sell-off will stall ahead of tomorrow’s PCE data.

Resistances: 1.2730, 1.2825

Supports: 1.2620, 1.2520