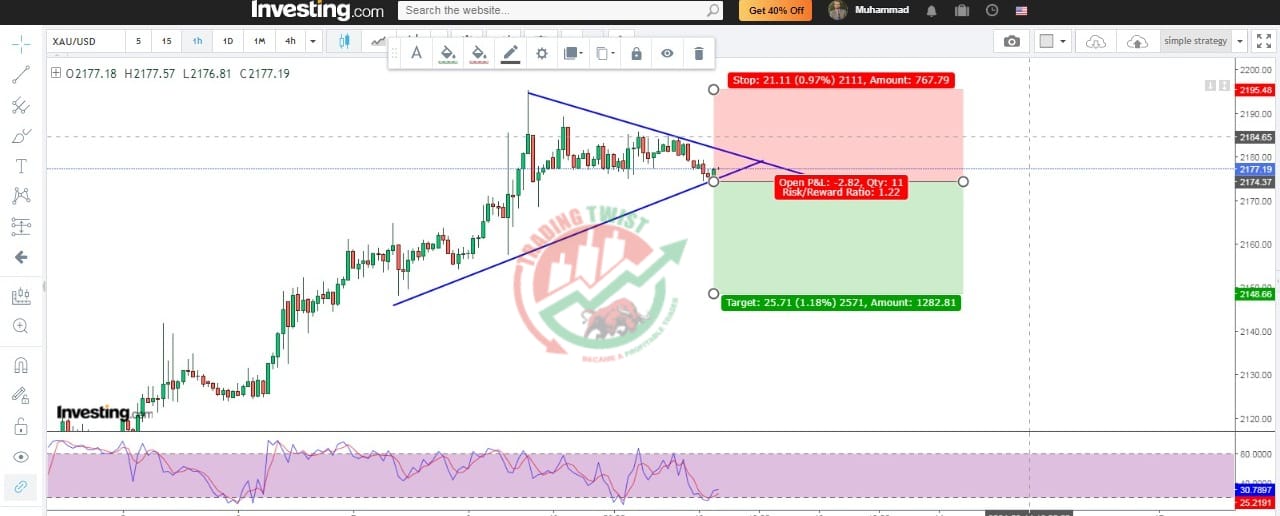

GOLD XAUUSD Chart Technical Outlook exits overbought conditions, set to benefit from potentially low US CPI to challenge $2,195 and beyond

Is the correction over? After hovering well in overbought territory for long days – at least according to the 4h-RSI – XAU/USD seems ready for the next significant move.

Resistance is at $2,195, followed by $2,205 and $2,212, the Fibonacci 138.2% and 161.8% extensions of the $2,168-$2,195 range. Support below $2,168 is at $2,149.

Fundamentals support fresh gains as well. Fed Chair Jerome Powell set a relatively low bar for cutting rates later this year – a mere confirmation that inflation is falling, rather than another significant decline. The Consumer Price Index (CPI) report due at 12:30 GMT is critical.

The most important component is Core CPI MoM, which is expected to have risen by 0.3% in February. Solely meeting this goal would push US 10-year yields down, and yieldless Gold would benefit.

All in all, the precious metal has ended its consolidation and is ready for the next move. With

I am sure this piece of writing has touched all the internet viewers, its really really pleasant

article on building up new weblog.