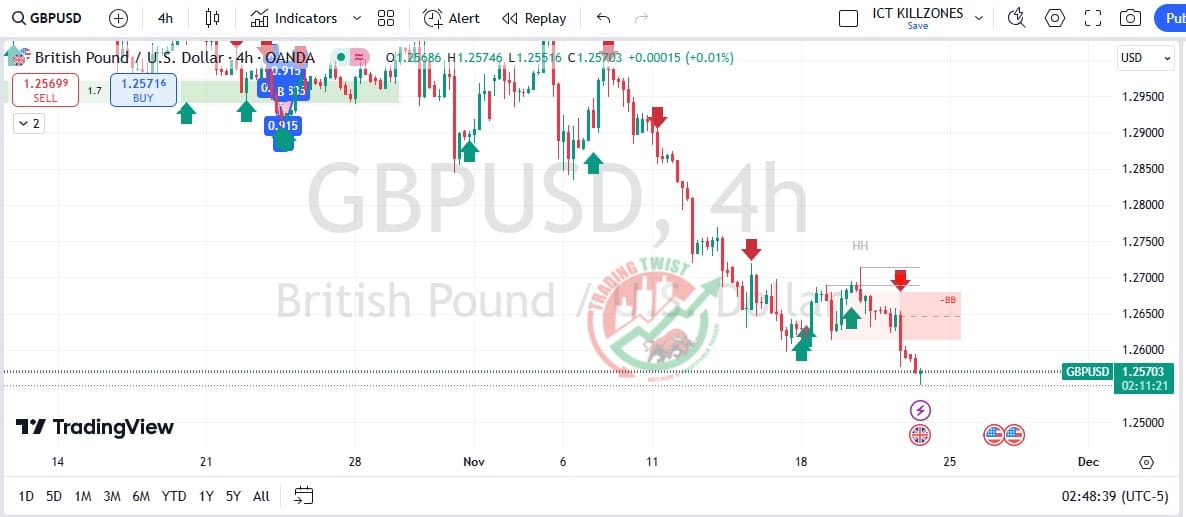

GBPUSD Chart Technical Outlook is set to extend losses after weak UK data, next support is at 1.2510

Retail consumption contracted 0.7% in the UK in October, well below the market consensus of a 0.3% decline, with the Core retail sales 0.9% down, more than twice the -0.4% anticipated by the market.

These figures have increased pressure on an already vulnerable Pound, while the USD maintains its firm footing, supported by strong data and investors’ hopes that Trump’s policies will stimulate growth and boost inflation.

On Thursday, US Jobless claims beat expectations with their lowest increase in seven months. Today the focus is on November’s preliminary PMI figures, another good reading would cast doubt on a Fed cut in December and push the pair lower.

The next support levels are 1.2510 and 1.2445. Resistances are the previous support, at 1.2615 and 1.2700.