GBP/USD Chart Technical Outlook is a widely traded currency pair in the forex market. Technical analysis involves studying historical price data and patterns to make predictions about future price movements. Here are a few common technical indicators and their potential interpretations for GBP/USD:

- Trend Analysis: Traders often look for trends in price movements to determine the overall direction of the market. Upward trends indicate bullish sentiment, while downward trends suggest bearish sentiment.

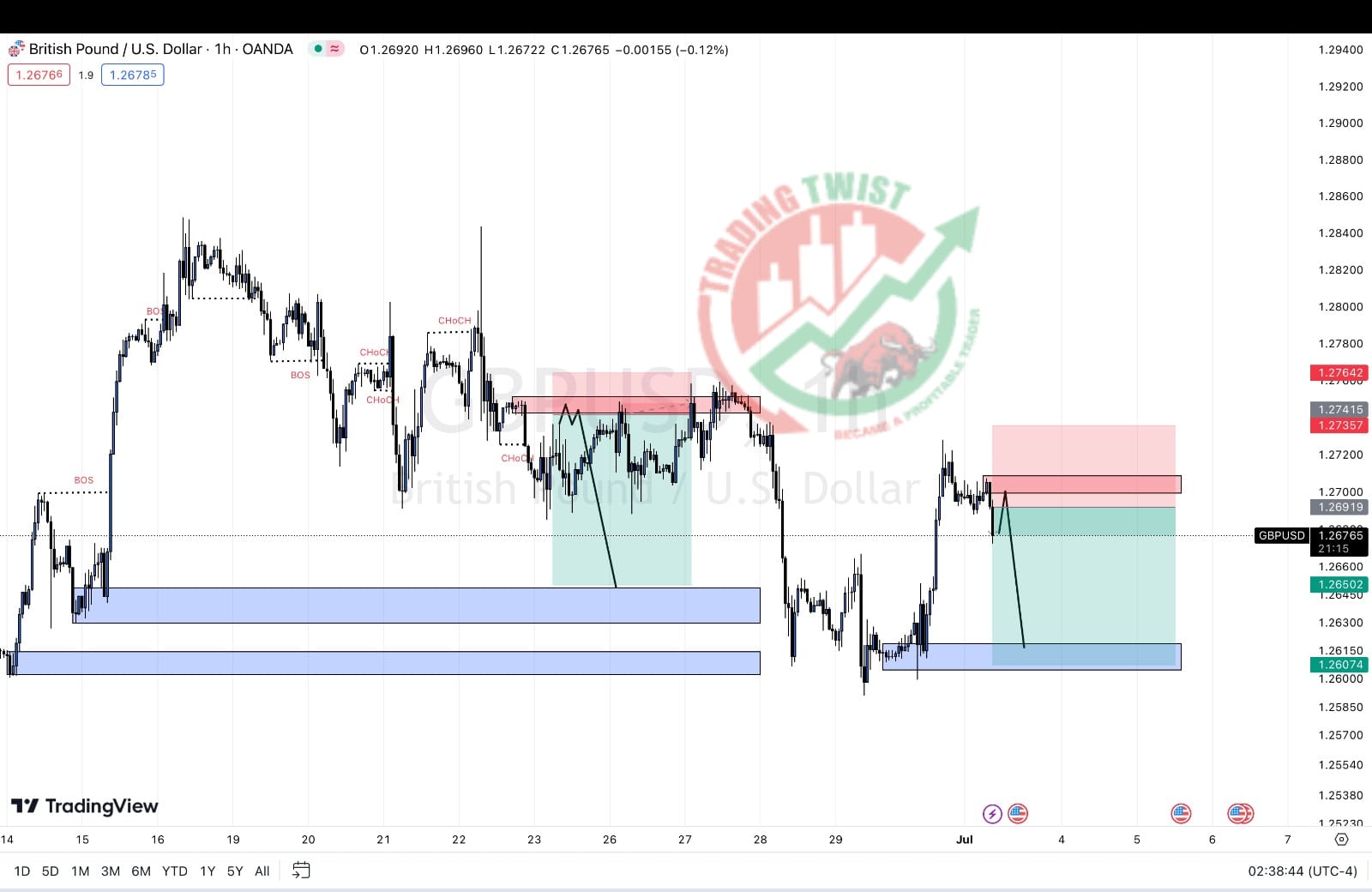

- Support and Resistance Levels: Support levels are areas where buying pressure may emerge, potentially preventing further price declines. Resistance levels, on the other hand, are areas where selling pressure may increase, potentially halting upward price movements.

- Moving Averages (MA): Moving averages help smooth out price fluctuations and identify trends. The 50-day and 200-day moving averages are commonly used. Golden Crosses (50-day MA crossing above 200-day MA) and Death Crosses (50-day MA crossing below 200-day MA) can be considered as potential bullish or bearish signals, respectively.

- Relative Strength Index (RSI): The RSI measures the strength and speed of price movements. Levels above 70 indicate overbought conditions, potentially signaling a price correction. Levels below 30 suggest oversold conditions, potentially indicating a price rebound.