DXY Chart Technical Outlook US Dollar Index resumes decline on Chinese hopes, US data eyed, European weakness may limit it to 1.0191. The safe-haven US Dollar is under pressure due to fresh hopes of stimulus from China. If the global economy receives a boost, there is less demand for the Greenback.

The US Dollar could also suffer from weak data. Recent economic figures have been downbeat, and there is room for a disappointing Durable Goods Orders report later in the day.

The DXY is a basket of currencies against the US Dollar, where the most prominent money is the Euro, with 57%. PMIs and yesterday’s German IFO data were poor, showing weakness in the old continent. This factor could limit the DXY’s falls.

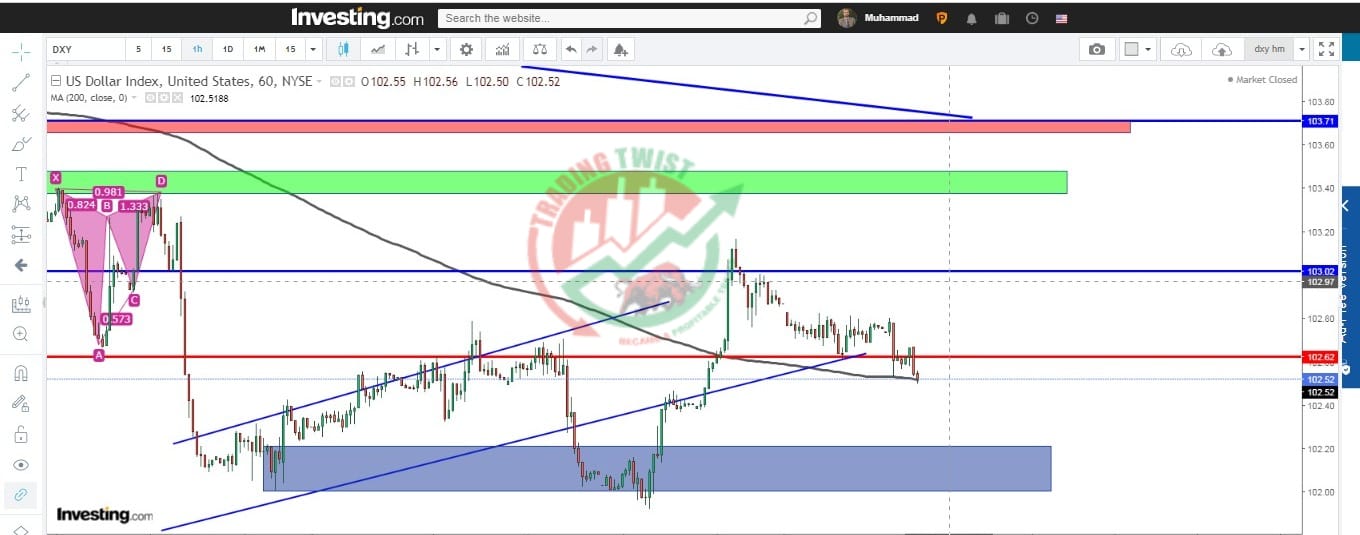

Technically, the picture is mixed. Support is at 101.91, which is a strong one. It is followed by 101.52 and then stubborn 101.01. Resistance is at 103.18, which the 4h-200 SMA defends. Further above, 103.75 is eyed.

All in all, I expect a moderate decline in DXY.