On the daily (D1) timeframe, let’s analyze the EURCHF Chart Technical Outlook:

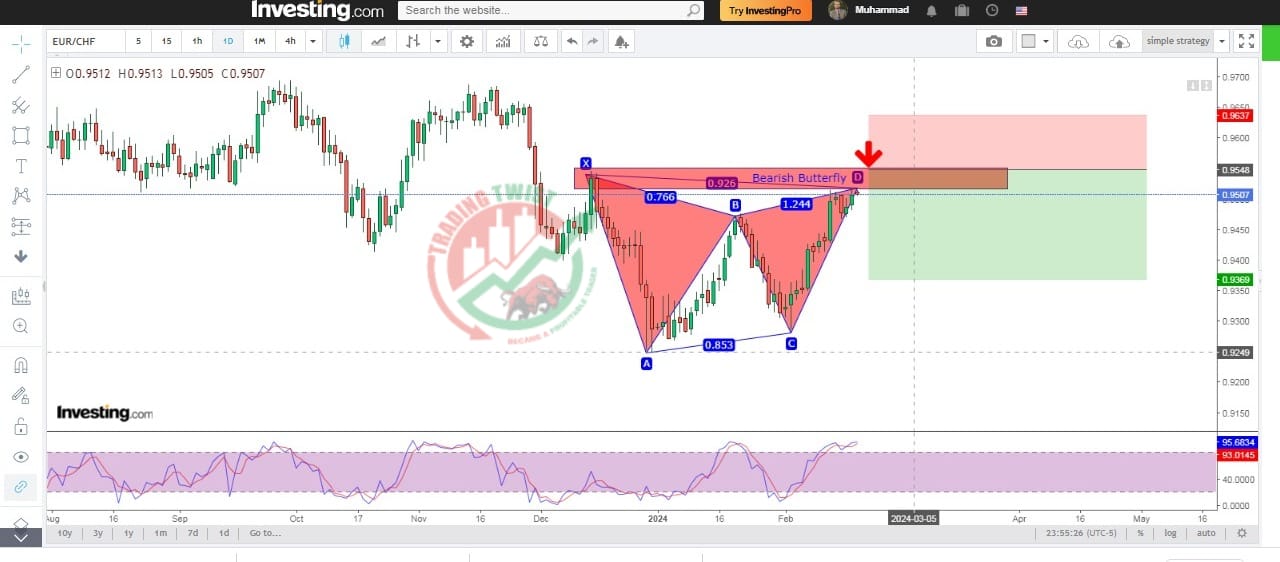

- Trend Analysis: EUR/CHF appears to have been in a predominantly sideways movement or a slight downtrend recently. It’s essential to confirm whether the pair is in a clear trend or ranging market conditions.

- Support and Resistance Levels: Identify key support and resistance levels based on recent price action. These levels can provide insights into potential reversal or breakout points.

- Moving Averages: Utilize moving averages such as the 50-day and 200-day moving averages to assess the trend direction and potential areas of support or resistance.

- Technical Indicators: Consider using oscillators like the Relative Strength Index (RSI) or the Moving Average Convergence Divergence (MACD) to gauge momentum and potential reversal points.

- Chart Patterns: Look for any recognizable chart patterns such as triangles, flags, or head and shoulders formations, which could indicate potential future price movements.

- Fundamental Factors: Keep an eye on any fundamental developments or economic releases that could impact the EUR/CHF pair, such as monetary policy decisions, economic data releases, or geopolitical events.