EURUSD Chart Technical Outlook set to resume gains toward 1.0895 as European traders return, ECB rate cut priced in.

A rate cut is coming to Europe before the US – but that is already fully priced in. Officials at the European Central Bank signaled that borrowing costs will begin coming down in June, while the Federal Reserve is only expected to kick it off in September. ECB President Christine Lagarde will speak later in the day and is unlikely to provide comments that are more dovish than current expectations.

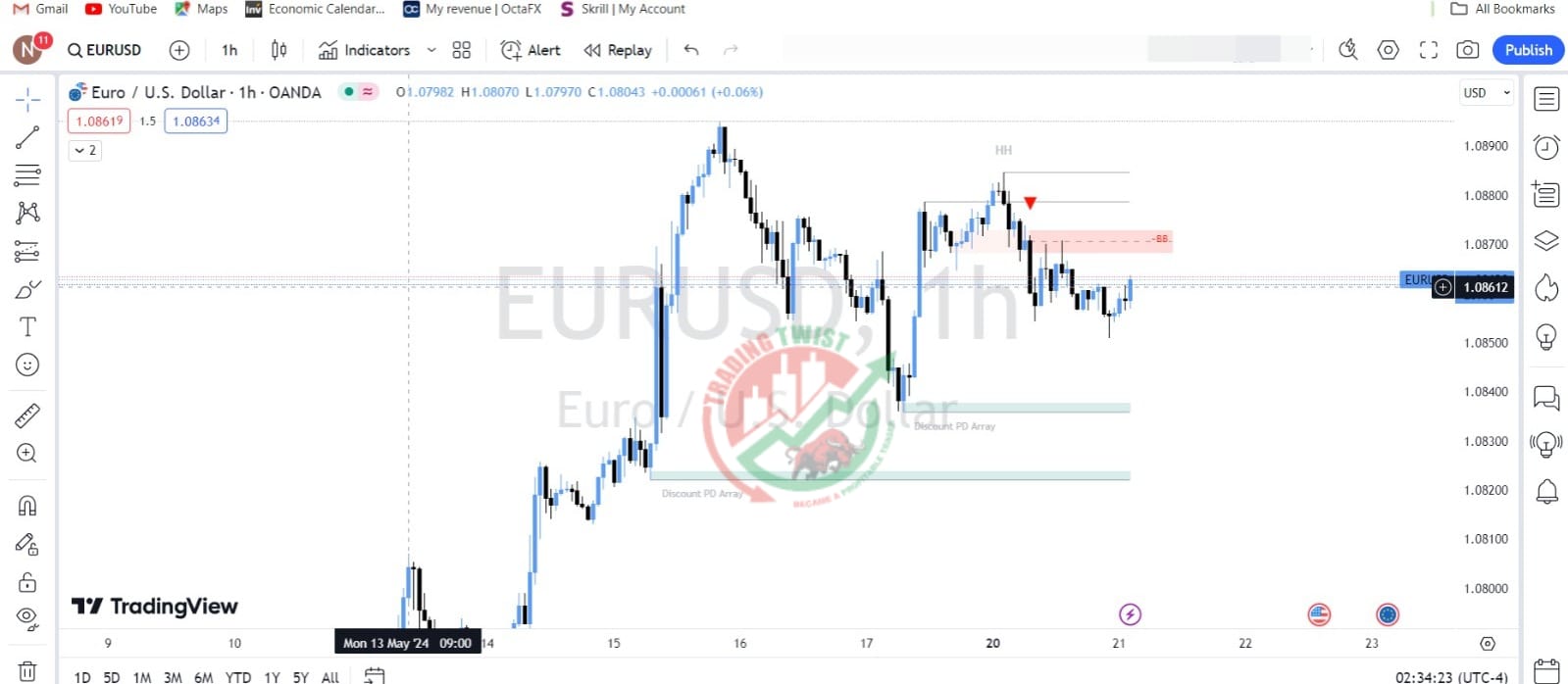

EUR/USD had a slow day on Monday when many European countries were on holiday. Things could shake up now, with bulls eyeing the recent high of 1.0895, which is followed by 1.0943. Support is at 1.0846, closely followed by 1.0812. The broad trend remains on the upside, as seen by the rising 4h-50 SMA.