GBPCHF Chart Technical Outlook might extend losses to the 1.1250 area on a dovish BoE

The Pound is trading lower across the board, and the GBP/CHF is testing support at 1.1330, with all eyes on the Bank of England. The market has already assumed that the SNB has started its easing cycle, but the BoE has room to surprise if they hint towards rate cuts in June.

UK inflation is cooling fast and the economy shows signs of weakening. This might increase the number of votes favouring a rate cut later today, which would push the Pound lower.

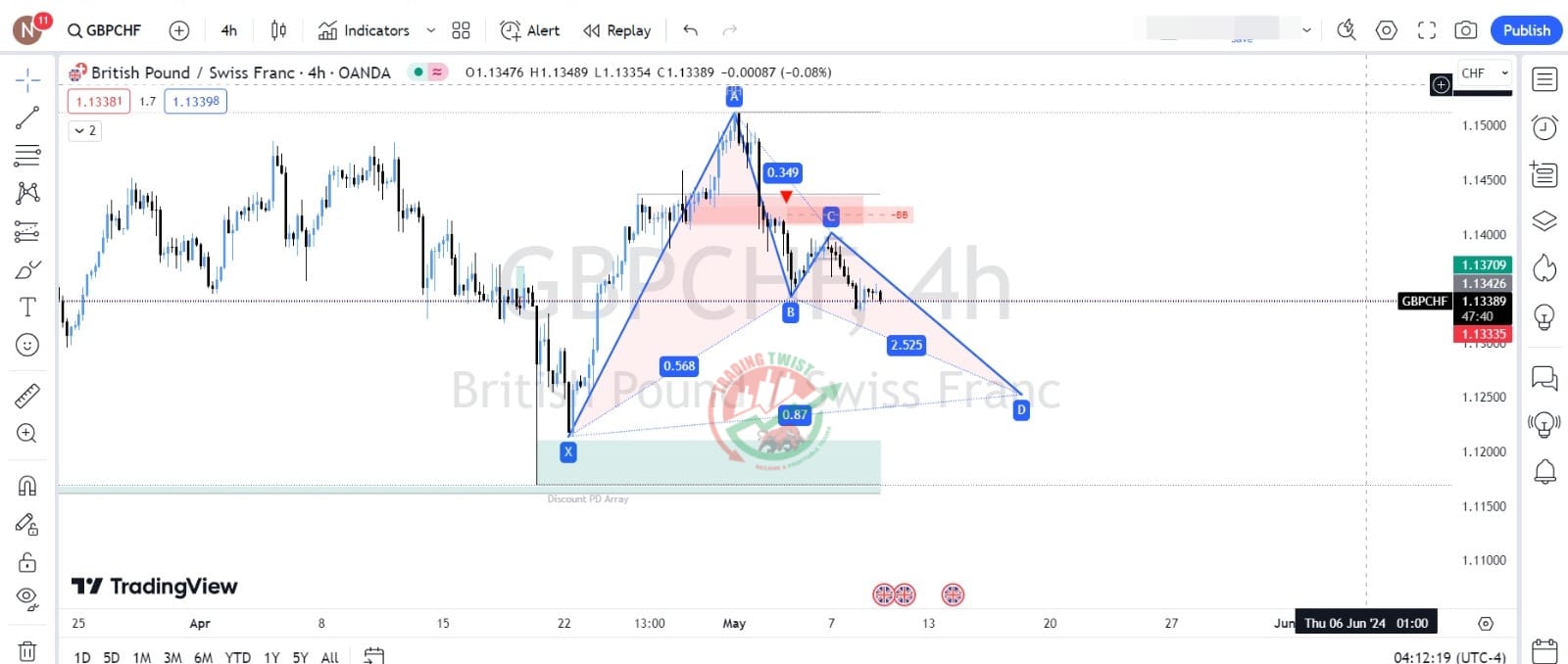

Such a scenario might contribute to complete the C-D lego of a Gartley Pattern, targeting 1.1250 area. A break of 1.1400 resistance negates this view and opens the path towards 1.1485.