The technical outlook for the GBPNZD currency pair today suggests a potential trading opportunity based on key chart indicators and patterns. Traders and investors closely analyze these technical factors to identify potential entry and exit points for their trades.

Currently, the GBPNZD pair is exhibiting a mixed sentiment, indicating a range-bound or indecisive market in the near term. This suggests that traders may need to exercise caution and look for additional confirmation before taking positions on the currency pair.

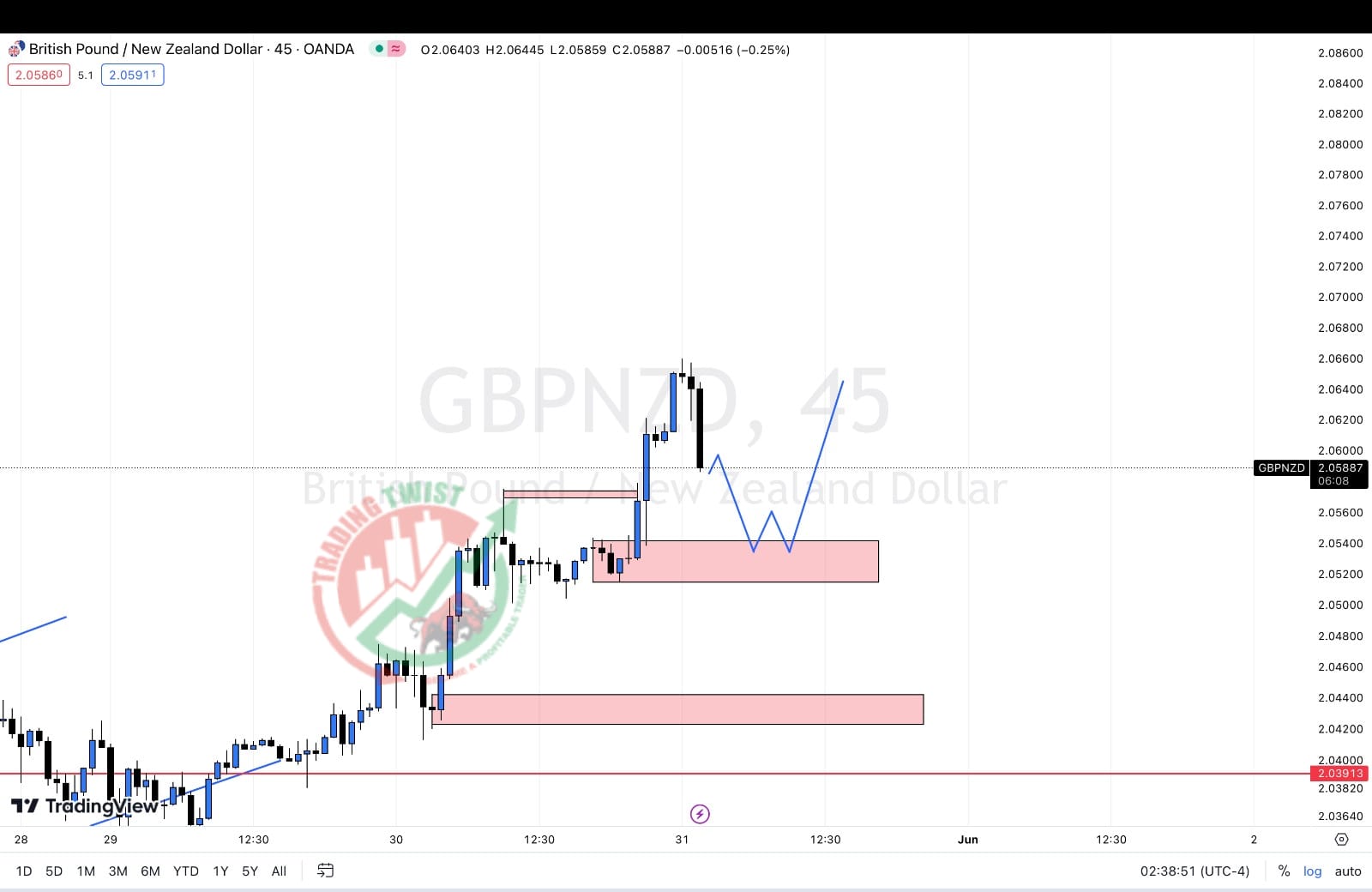

One of the key technical indicators to consider is the trendline. Traders should monitor the trendline to identify any breakouts or reversals. If the GBPNZD pair breaks above a key resistance level on the trendline, it could signal further upside potential. Conversely, if it breaks below a significant support level, it may indicate potential downside momentum.

Moving averages can also provide valuable insights into the trend direction. By comparing the shorter-term moving average with the longer-term moving average, traders can gauge the overall trend strength. If the shorter-term moving average crosses above the longer-term moving average, it may indicate a bullish trend and potential buying pressure on the GBPNZD pair. Conversely, a cross below could suggest a bearish trend.

In addition, support and resistance levels play a crucial role in technical analysis. These levels act as psychological barriers where buying or selling pressure may intensify. Traders should pay attention to significant support and resistance levels to anticipate potential price reactions and make informed trading decisions.

However, it is important to remember that technical analysis is not foolproof and should be used in conjunction with other forms of analysis and risk management strategies. Fundamental factors, such as economic news, geopolitical events, and market sentiment, can quickly shift the dynamics of the currency pair, leading to unexpected price movements.

Traders should exercise caution, consider multiple indicators and signals, and employ proper risk management techniques. This includes setting stop-loss orders, managing position sizes, and staying updated with relevant news and market developments.

It’s important to note that the forex market is highly volatile and unpredictable. Traders should conduct their own analysis, use discretion, and consider seeking professional advice when necessary.

Disclaimer: This technical outlook for the GBPNZD currency pair is for informational purposes only and should not be considered financial advice. Trading in the forex market involves substantial risk, and traders should only trade with the capital they can afford to lose. It is recommended to consult with a financial advisor or conduct thorough research before making any investment decisions.