GBPUSD Chart Technical Outlook set to resume gains after US Dollar completes correction, 1.3431 in play

It takes a spark – US New Home Sales beat estimates, giving investors the pretext to cover US Dollar shorts. The Greenback recovered, sending GBP/USD down from the highs. However, the big picture remains unchanged – interest rates in the US are below those in the UK.

Moreover, the Fed seems open to another 50-bps cut. Today’s calendar is packed with US releases: final GDP, Durable Goods Orders, and jobless claims – which matter most. Labor market data matter most to markets. Even if the data does not miss estimates, merely meeting estimates would be sufficient to keep the pressure on the US Dollar.

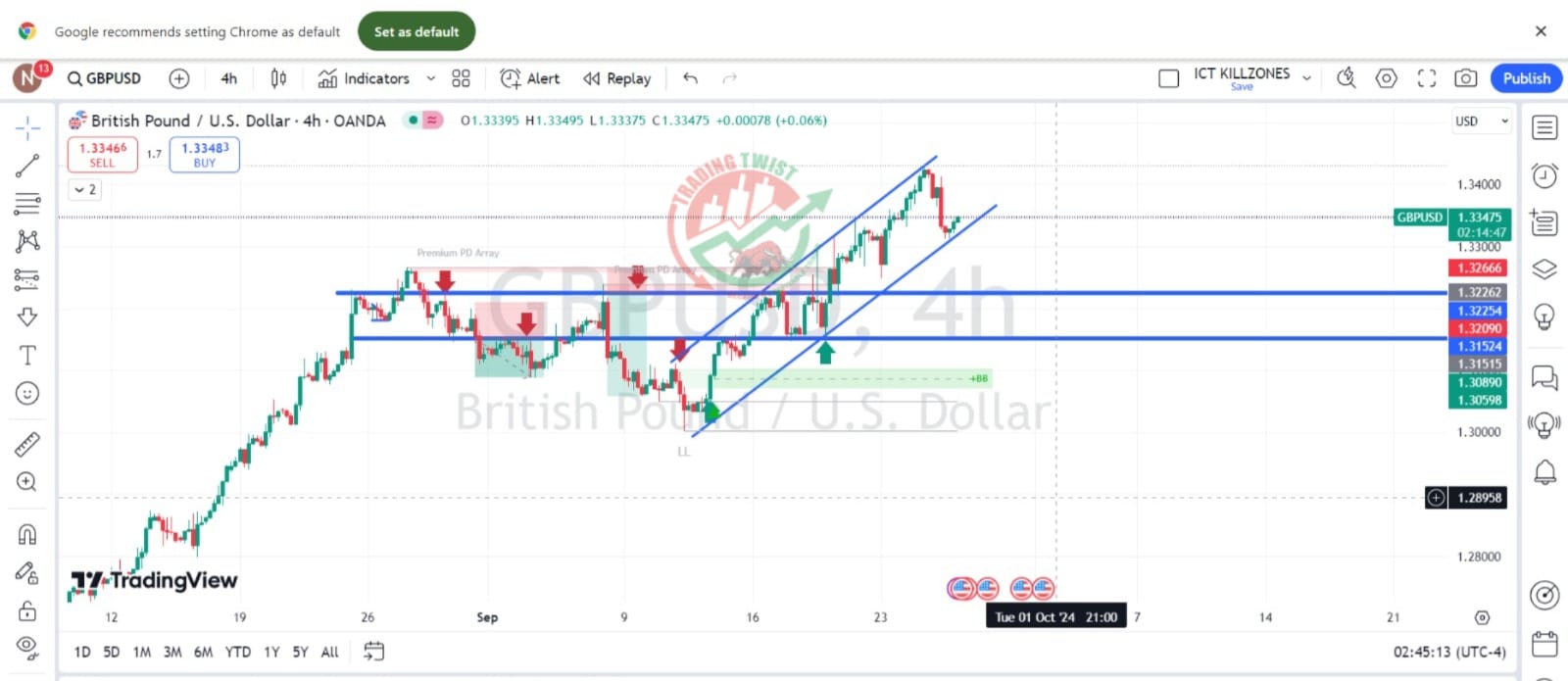

GBP/USD faces some resistance at 1.3359, and the bigger target is the peak of 1.3431. Support is at 1.3311, where the pair bounced, then at 1.3250. The broad trend remains to the upside.