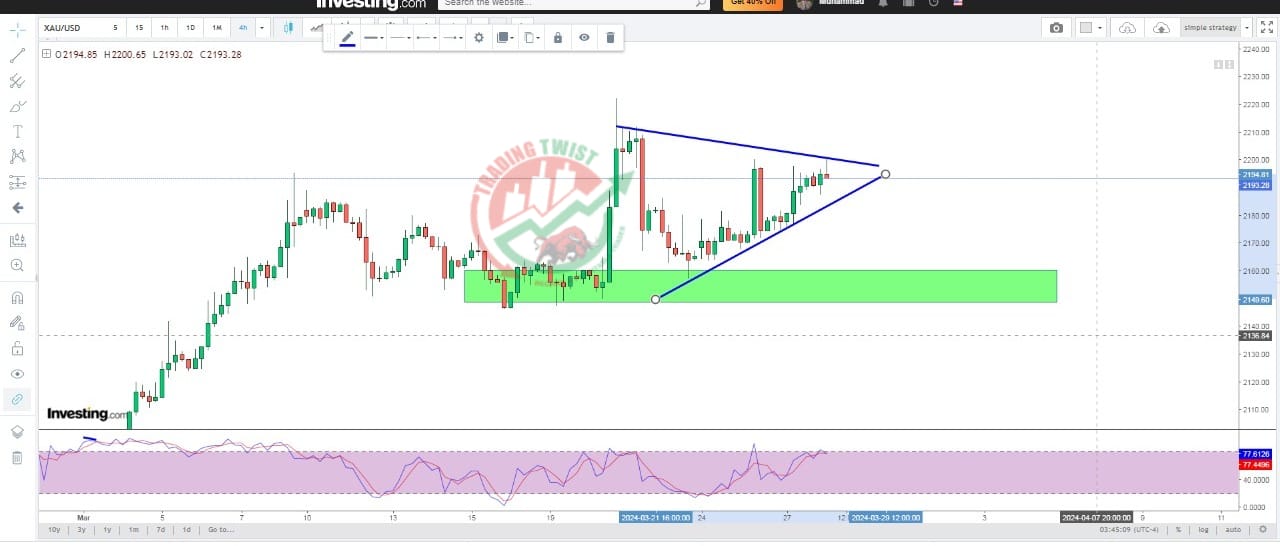

GOLD XAUUSD Chart Technical Outlook is set for a downside correction toward $2,173 on end-of-month flows and hawkish Fed comments.

Can XAU/USD challenge the peak of $2,223? I do not think it will happen today. Gold faces resistance at $2,199, and in case it breaks $2,223, the next level to watch is $2,248, which is the Fibonacci 138.2% extension of the recent $2,158-$2,223 range. Support is at $2,173, followed by $2,158.

While Christopher Waller is known as a hawk, his comments pushing back against cutting rates – he wants to begin later and fewer reductions in general – impact markets. US 10-year yields remain elevated, and that may weigh on yieldless Gold.

Today’s data releases are the final GDP for Q4 2023 and weekly jobless claims. To have a meaningful impact, both would need to point to the same direction. The more likely scenario is that the data offset each other and that there is no change to the risk-off mood in markets.

Moreover, today is the last trading day of the quarter in many places which takes the day off.