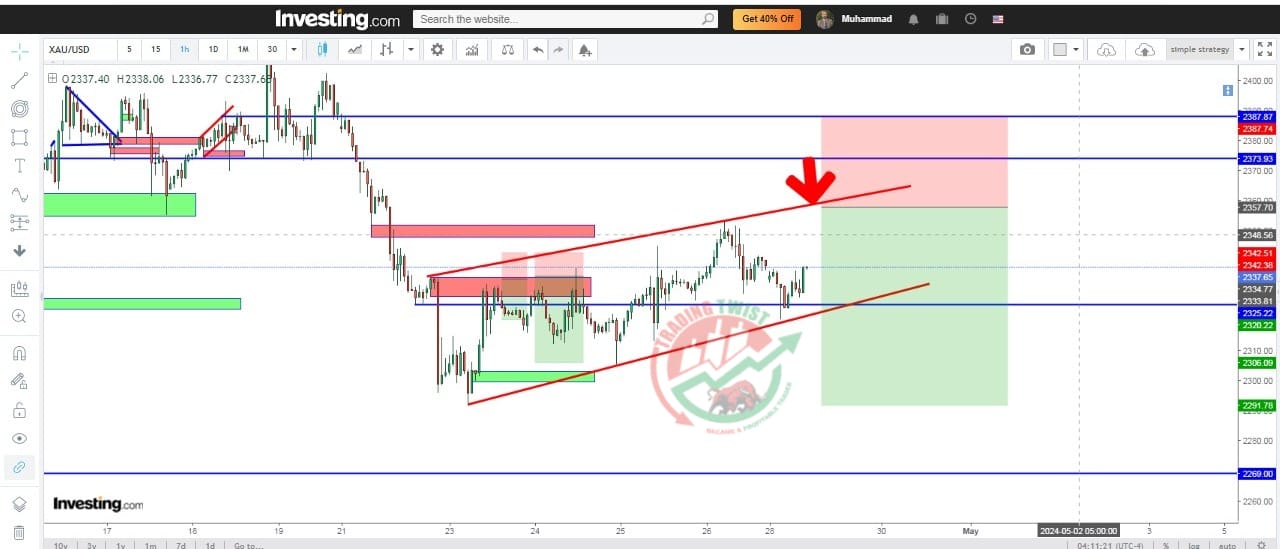

GOLD XAUUSD Chart Technical Outlook might be ready to end its corrective recovery

Gold has been trading in an upside channel since bouncing up at the 50% retracement of the late March- early April rally. Fundamental suggests that this phase might be about to end, which would lead to another leg down for the precious metal

The strong US inflation figures are forcing the Fed to delay its monetary easing plans. The CME Fed Watch Tool shows that even hopes of a September cut are dwindling. The US Central is meeting on Wednesday and might release a hawkish statement, which would push the US Dollar higher and weigh on Gold.

Beyond that, the increasing expectations of a cease-fire in Gaza would ease some of the market uncertainty that has been fuelling Gold demand during the last months.

The XAU/USD is trading moderately lower today, aiming for the bottom of the channel at $2,315. A breach below here and $2,295 would confirm a bearish flag, with its measured target, at $2,255. Resistances are $2,358 and $2,400.