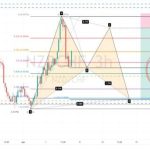

S&P500 Chart Technical Outlook S&P500 (US500) loses the bullish momentum, looking to fade rallies

S&P500’s broad bias is bullish, but prices have broken the structure to the downside to build a corrective pullback to the recent rally. The risk aversion was spurred by geopolitical risk in the Middle East and hawkish comments from the Fed officials. Investors are eyeing the NFP, wages, and unemployment data today to evaluate the upcoming monetary policy.

I expect a temporary upside reaction ahead of the events toward the broken level of 5,185. If data is strong or mixed, the sell-off would continue. If data is weak, further upside reaction could push prices toward 5,230. In both scenarios, I expect the rally to be sold later as the bullish momentum has faded. A consolidation phase or a reversal is expected. Supports are located at 5,115 and 5,080.