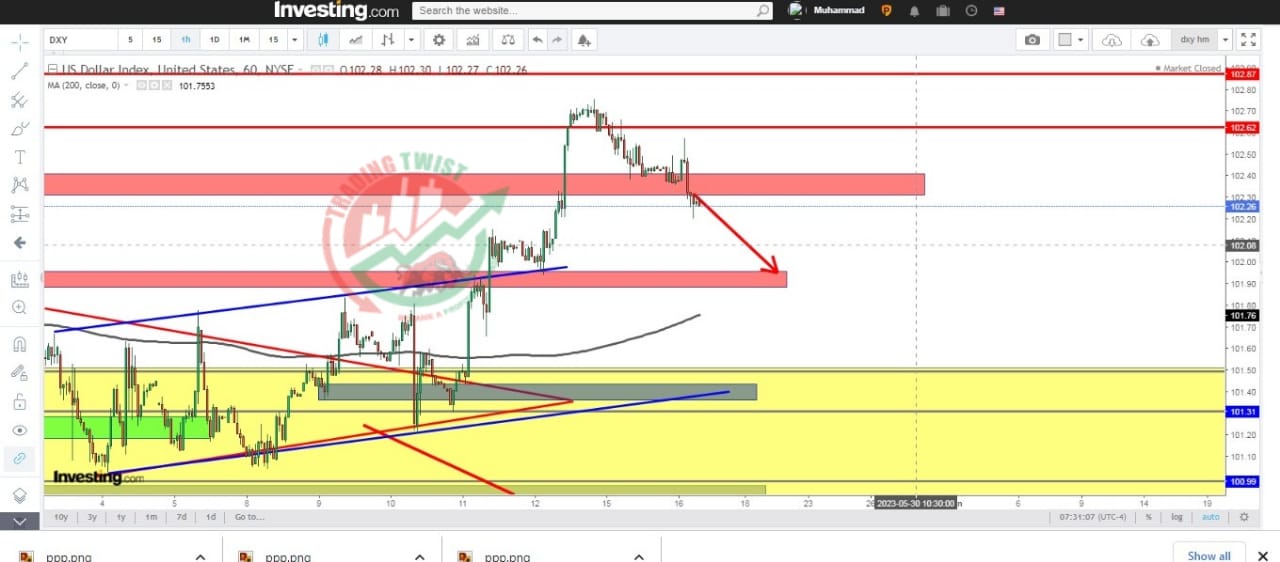

US Dollar DXY Chart Technical Outlook is losing momentum after rejection 102.75 resistance area

The US dollar index is looking heavy on Tuesday, giving away gains with the investors increasingly wary about a debt default with bipartisan representatives unable to reach a deal to lift the borrowing limit.

Later today, a slew of Fed speakers and news from the Biden – McCarthy meeting may have a significant impact on US dollar volatility.

The near, term bias remains positive, although technical indicators on intra-day charts are turning lower which might entice bears to revisit the 102.00 area with the next support at 101.45.

On the other hand, an impending bullish cross on 4-hour SMAs might restore the bull’s confidence if the clouds over the US debt limit start to fade, which would push the index towards the next resistance levels 102.75 and 103.30.