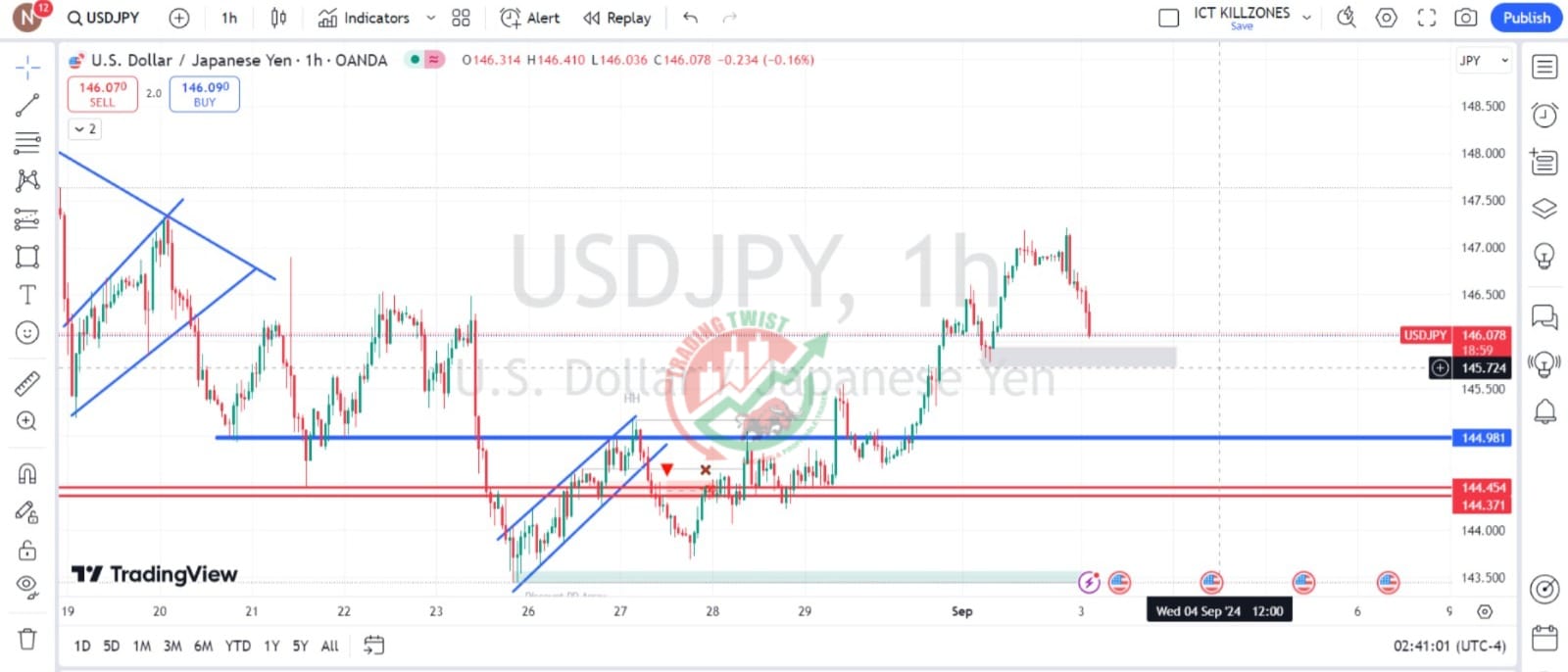

USDJPY Chart Technical Outlook drifts lower on risk aversion, pullbacks are likely to be bought

The Dollar is pulling lower with the Japanese Yen supported by an increasing aversion to risk, as investors await the release of a slew of key US figures. The broader trend, however, remains positive with supports 145.80 and 144.65 likely to hold bears. Resistances are 147.20 and 149.45.

US markets open today after a long weekend. The ISM manufacturing PMI is expected to show some improvement, yet it is still at contraction levels.

The Yen, On the other hand, is lacking a driver of its own to support a trend shift, as investors are hesitant about the timing of the BoJ’s next rate hike.

The main focus will be on the labour data, starting with US JOLTS Openings on Wednesday, ADP and Jobless Claims on Thursday and the widely expected Nonfarm payrolls on Friday. These figures will help to determine the size of the expected Fed cut in September and therefore, the Dollar’s near-term direction.