The XAG/USD chart technical outlook provides an analysis of the price action and key technical indicators for the XAG/USD pair. XAG/USD represents the exchange rate between silver (XAG) and the US dollar (USD).

In recent weeks, the XAG/USD pair has shown a mixed trend with periods of both bullish and bearish price movements. The overall price action has been characterized by a series of higher highs and higher lows, indicating a potential upward bias.

Examining the moving averages, the shorter-term moving average, such as the 50-day moving average, has recently crossed above the longer-term moving average, such as the 200-day moving average. This bullish crossover suggests that the upward momentum may continue in the near term.

The Relative Strength Index (RSI), a momentum oscillator, has fluctuated within a neutral range, reflecting a lack of strong directional bias. This suggests that the pair may continue to consolidate or experience choppy price movements in the short term.

Key support and resistance levels

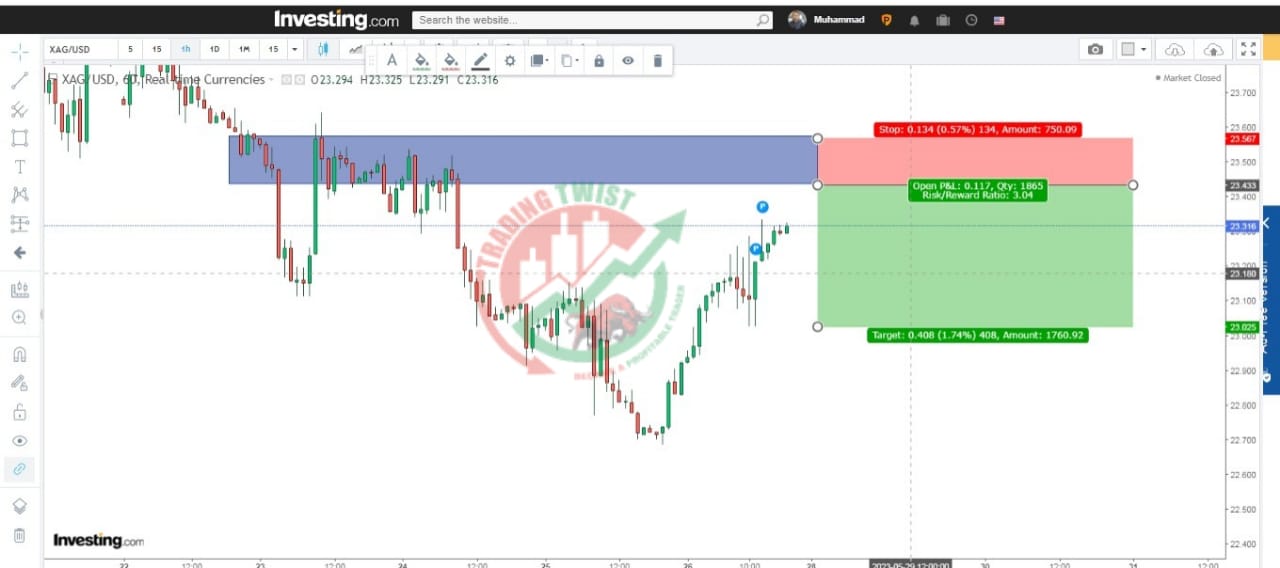

Key support and resistance levels should be closely monitored on the XAG/USD chart. Immediate support can be observed near the previous lows around $24.00, while resistance is seen around the recent highs near $28.00. A breakout above the resistance level could indicate further upside potential, potentially targeting the next resistance level around $30.00.

It is important to note that the XAG/USD pair can be influenced by various fundamental factors, including factors that affect the demand and supply of silver, economic data releases, geopolitical events, and overall market sentiment. Therefore, it is advisable to integrate fundamental analysis alongside technical analysis for a comprehensive understanding of the market.

Traders and investors should closely monitor the XAG/USD chart and adjust their strategies accordingly. It is crucial to practice effective risk management and consider other factors beyond technical analysis when making trading decisions.