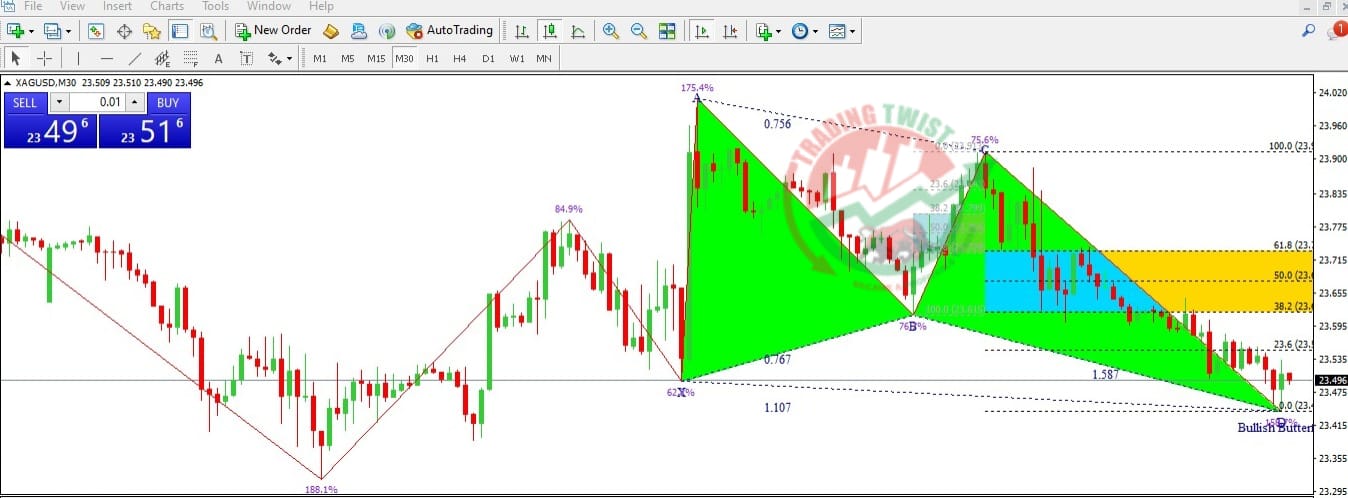

Silver Price (XAGUSD Chart Technical Outlook) remains on the back foot around the intraday low of $23.45 heading into Tuesday’s European session.

In doing so, the bright metal drops for the second consecutive day while extending the U-turn from the 50-SMA, as well as staying below a one-week-old descending resistance line. Additionally favoring the bright metal sellers is the impending bear cross on the MACD indicator.

With this, the Silver price appears vulnerable to retesting the monthly low of nearly $23.30 marked on Friday. Also on the XAG/USD bear’s radar is the 61.8% Fibonacci retracement level of March-May upside, near $23.25.

In a case where the Silver price remains bearish past $23.25, the $23.00 could act as the last defense of the buyers.

On the flip side, the 50-SMA and one-week-old descending resistance line, close to near $23.85 and $23.90 in that order, restrict short-term recovery of the Silver price.

Even if the bright metal remains firmer past $23.90, the $24.00 round figure and a seven-week-old horizontal resistance area around $24.50-55 will be in the spotlight.

Overall, the Silver price remains on the bear’s table unless crossing $24.55.