XAUUSD Chart Technical Outlook Gold set to move higher on a 50-bps cut, bull’s eye a break of $2,590*

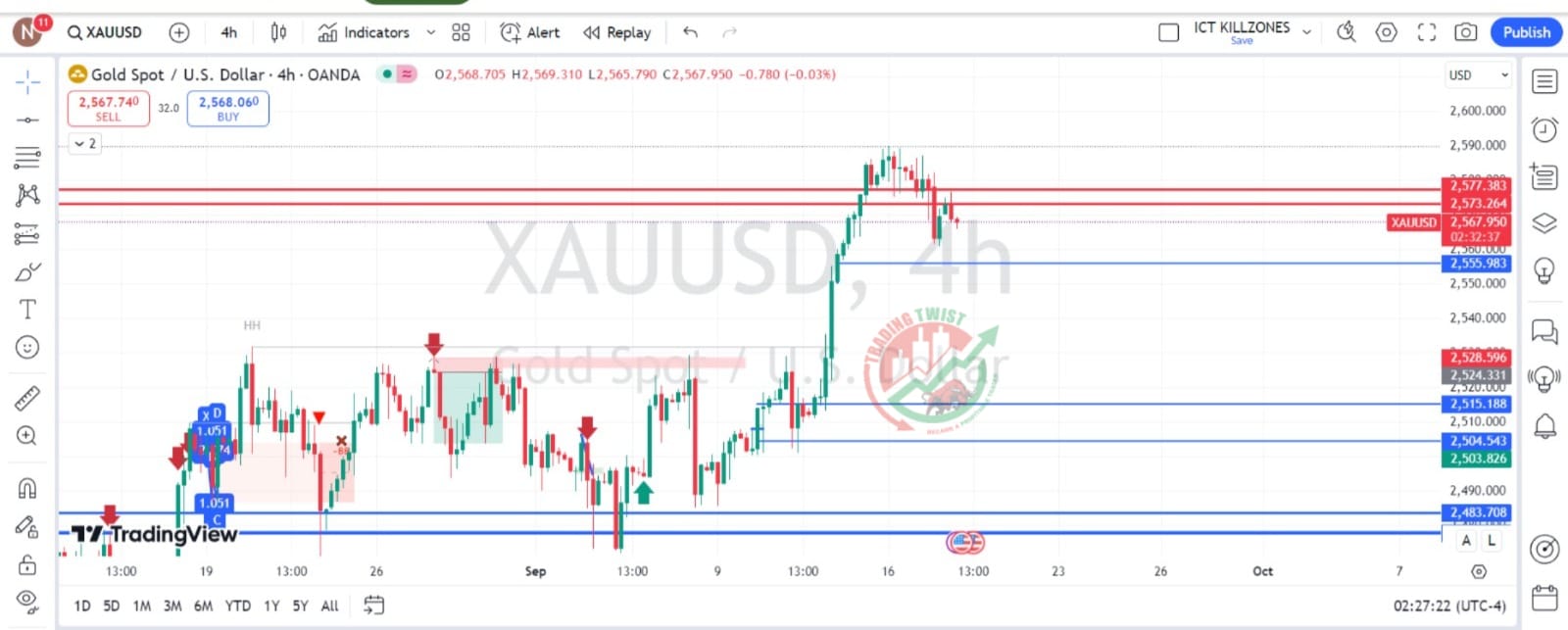

Relatively upbeat US retail sales triggered some profit-taking on XAU/USD, and the precious metal fell, finding support at $2,560. The next line to watch is $2,531. Resistance is at $2,573, followed by $2,590, then $2,597 and $2,601.

What will the Federal Reserve do? Markets are pricing a 60% chance of a 50-bps rate cut. So, a 25-bps cut would be a bigger surprise and would trigger a bigger move in markets, for Gold it would be to the downside. However, a 50-bps cut is not fully priced in. Such a move would trigger some upside.

While Fed officials tend to begin a cycle with a small 25-bps move, I think that they would not to disappoint markets, and would go for a 50-bps cut. If that happens, Fed Chair Jerome Powell will likely accompany the decision with a message that the next moves might be smaller. That might trigger high volatility.

In any case, we will be covering the event live.