Widening fractures in global trade networks, influenced by geopolitical tensions, have raised alarms at the International Monetary Fund (IMF). The IMF fears these trends could lead to a breakdown in world trade, potentially slowing global economic growth.

Gita Gopinath, the IMF’s First Deputy Managing Director, highlighted these concerns in a recent speech at Stanford. “Countries are reevaluating their trading partners based on economic and national security concerns,” Gopinath stated. She warned that if this trend continues, “we could see a broad retreat from global rules of engagement and, with it, a significant reversal of the gains from economic integration.”

Protectionism on the Rise

The IMF’s warning comes as nations are increasingly adopting protectionist trade policies, moving away from globalization. This shift has already impacted global trade, which grew by only 0.2% in 2023—the slowest rate in 50 years—according to Ayhan Kose, Deputy Chief Economist of the World Bank. “It would have declined outright but for the growth of trade in services,” Kose noted, while goods trade alone contracted by approximately 2.0%, the sharpest decline outside of a global recession this century.

Geopolitical Divides Deepening

Long-standing geopolitical issues like Brexit and the US-China trade war have laid the groundwork for current trade discord. However, recent conflicts, including the war in Ukraine and tensions in the Middle East, have intensified these divisions.

BRICS and De-Dollarization

A notable trend within this fragmentation is the BRICS nations’ efforts to reduce their reliance on the US dollar.

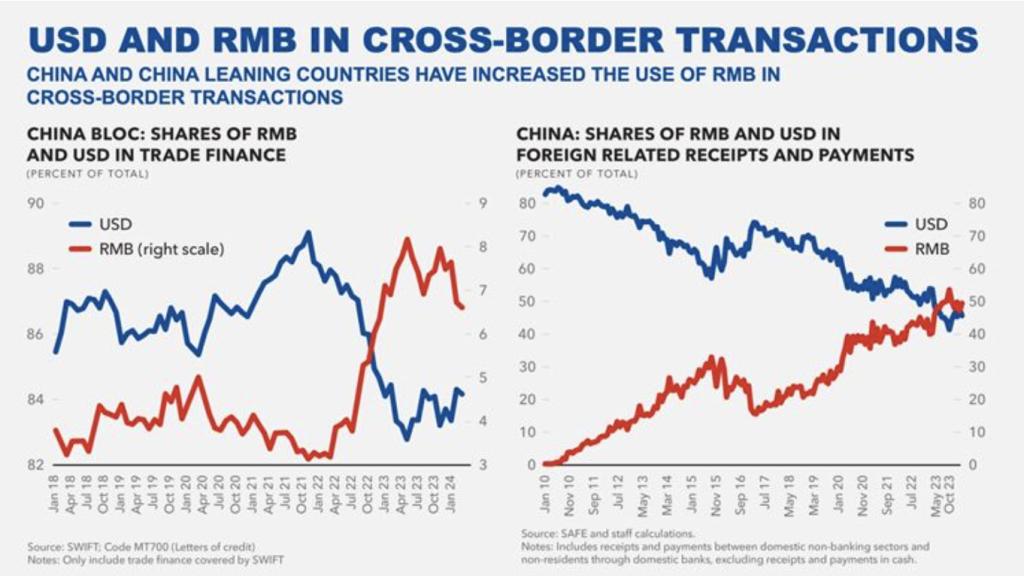

At a recent meeting, Russian President Vladimir Putin and Chinese President Xi Jinping emphasized the benefits of settling trade in their national currencies, with Putin noting that 90% of their bilateral payments are now made in rubles and yuan.

Despite the dominance of the US dollar—accounting for 80-90% of global cross-border transactions—BRICS countries aim to mitigate the impact of US-imposed trade sanctions and asset seizures. Higher interest rates in the West have further incentivized this move, as many emerging markets hold substantial US dollar-denominated debt, making debt servicing costly.

Currency and Inflation Challenges

Emerging markets face severe challenges due to currency devaluation and dollar shortages. Nations like Argentina, Egypt, and Ethiopia have struggled to maintain adequate dollar reserves, exacerbating inflation and economic instability.

Alternative Payment Systems

In response to these pressures, BRICS countries are developing alternatives to the SWIFT payment system. Russia’s System for Transfer of Financial Messages (SPFS) and China’s Cross-Border Interbank Payment System (CIPS) are notable examples. These systems provide options for international trade settlements, reducing reliance on the US dollar.

The Renminbi’s Rising Role

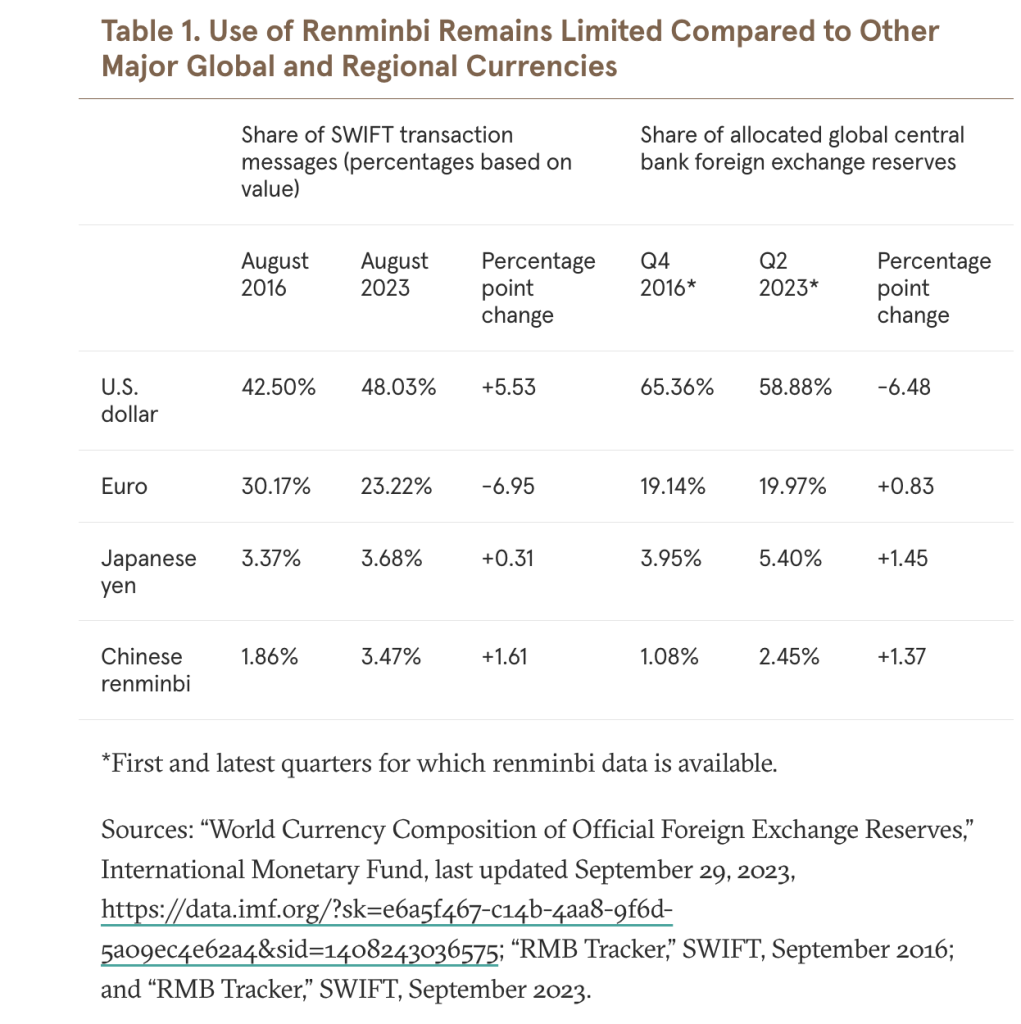

BRICS nations are also increasingly using the Chinese renminbi (RMB) for trade. While the RMB’s international use is still limited by China’s capital controls, its role as a medium of exchange is growing, with central banks boosting their RMB reserves.

Gold as a Strategic Asset

Amid this fragmentation, non-Western central banks have been hoarding gold. This trend reflects concerns about sanctions and a potential return to a gold standard-like system for currency stability. “The BRICS countries own a lot of gold,” noted Mike Maharrey of Money Metals Exchange, suggesting that gold could serve as a stable intermediary currency in international trade.

In summary, the increasing fragmentation of global trade networks underscores significant shifts in economic alliances and strategies. While these changes present challenges, they also open avenues for new forms of economic cooperation and stability.