A fake move in the Forex trading market is a price movement that is not representative of the underlying trend or sentiment in the market. Fake moves can occur for a variety of reasons, including market manipulation, news events, or trader sentiment.

Fake moves can be difficult to identify, as they may appear to be part of a legitimate trend or reversal. However, they are typically short-lived and are followed by a reversal or a return to the original trend.

Traders should be aware of fake moves and use caution when entering trades based on these movements. It is important to use a combination of analysis tools, such as technical chart patterns, fundamental analysis, and leading and lagging indicators, to increase the chances of identifying and avoiding fake moves.

How to identify fake moves in Forex trading?

There are several ways to identify fake moves in Forex Trading:

Look for unusual volume: A fake move is often accompanied by a sudden increase in volume, which can indicate that the move is not representative of the underlying trend or sentiment in the market.

Monitor news and economic events: Fake moves can often be triggered by news events or economic releases. Keeping an eye on these events can help traders anticipate potential fake moves and adjust their trading strategies accordingly.

Use leading and lagging indicators: Leading indicators, such as the Moving Average Convergence Divergence (MACD) and the Stochastic Oscillator, can help traders anticipate potential trend changes, while lagging indicators, such as the Moving Average and the Average Directional Index (ADX), can confirm trends that are already in progress. Using a combination of both types of indicators can increase the chances of identifying fake moves.

Look for divergences: Fake moves are often accompanied by divergences between the price and technical indicators, such as the MACD or RSI. Identifying these divergences can help traders anticipate potential fake moves.

Use caution when entering trades based on short-term movements: Fake moves are typically short-lived and are followed by a reversal or a return to the original trend. Traders should use caution when entering trades based on short-term movements and consider the overall trend or sentiment in the market before making a trade.

It is important to note that fake moves can be difficult to identify and traders should use a combination of analysis tools to increase the chances of identifying and avoiding them.

How to trade on the fake moves in Forex Trading?

Trading on fake moves in the Forex Trading Market can be risky and is not recommended for most traders. Fake moves are often accompanied by sudden increases in volume and are not representative of the underlying trend or sentiment in the market. They can be difficult to identify and may be followed by a reversal or a return to the original trend.

That being said, if a trader does decide to trade on a fake move, it is important to use caution and follow these steps:

Use a combination of analysis tools: Fake moves can be difficult to identify, so it is important to use a combination of analysis tools, such as technical chart patterns, fundamental analysis, and leading and lagging indicators, to increase the chances of identifying fake moves.

Set stop losses: Fake moves can be unpredictable, so it is important to set stop losses to limit potential losses.

Use caution when entering trades: Fake moves are typically short-lived, so traders should use caution when entering trades based on short-term movements and consider the overall trend or sentiment in the market before making a trade.

Monitor the market closely: Fake moves can be followed by a reversal or a return to the original trend, so it is important to monitor the market closely and be prepared to exit a trade if the fake move is not sustained.

Overall, it is important to exercise caution when trading on fake moves in the Forex market, as these moves can be risky and unpredictable. Most traders are better off avoiding fake moves and focusing on more reliable trends and signals.

What is the Difference between an actual breakout and a fake out?

An actual breakout in the Forex Market is a price movement that breaks through a key resistance or support level, signaling a potential trend change. An actual breakout is typically accompanied by increased volume and is confirmed by a sustained move in the direction of the breakout.

A fake out, also known as a false breakout, is a price movement that appears to break through a key resistance or support level but is followed by a reversal or a return to the original trend. A fake-out is often accompanied by a sudden increase in volume and is not representative of the underlying trend or sentiment in the market.

The main difference between an actual breakout and a fake-out is the sustainability of the price movement. An actual breakout is sustained and confirms a trend change, while a fake out is short-lived and is followed by a reversal or a return to the original trend.

Traders should be aware of both actual breakouts and fake outs and use a combination of analysis tools, such as technical chart patterns, fundamental analysis, and leading and lagging indicators, to increase the chances of identifying and avoiding fake outs.

Main Fake-out Chart Pattern:

A fake-out chart pattern is a pattern that appears to signal a trend change or a breakout but is followed by a reversal or a return to the original trend. Fake-out chart patterns can occur for a variety of reasons, including market manipulation, news events, or trader sentiment.

Some examples of fake-out chart patterns include:

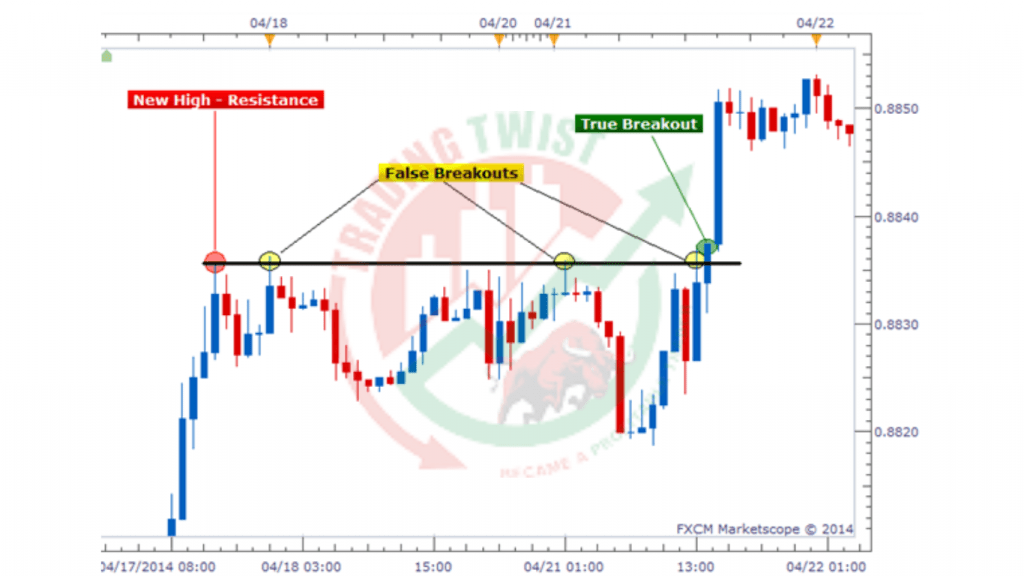

Fake breakout: This pattern appears to signal a breakout from a key resistance or support level, but is followed by a reversal or a return to the original trend.

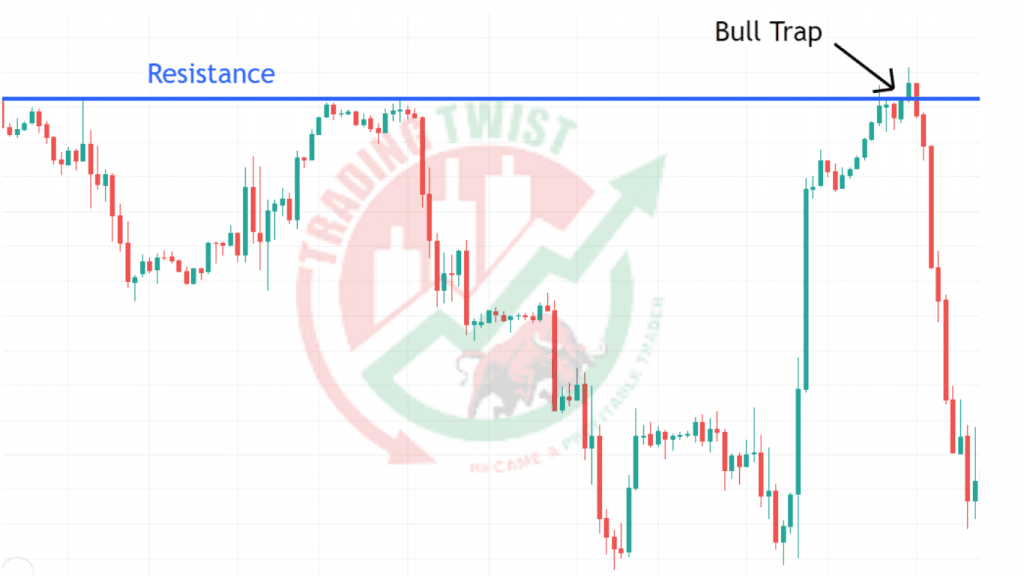

Bull trap: This pattern appears to signal the beginning of a bullish trend, but is followed by a bearish reversal.

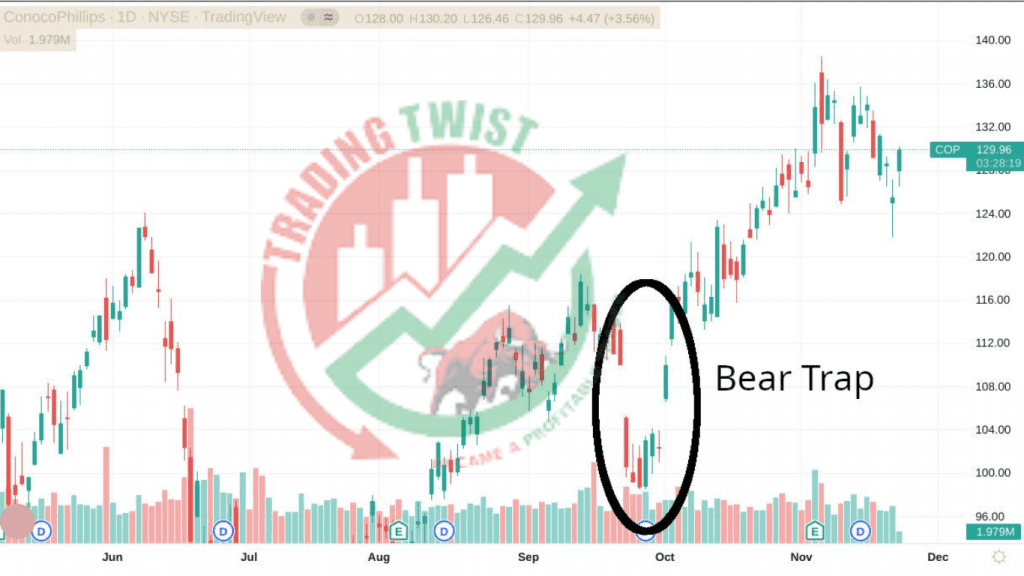

Bear trap: This pattern appears to signal the beginning of a bearish trend but is followed by a bullish reversal.

Fake-out chart patterns can be difficult to identify, as they may appear to be part of a legitimate trend or reversal. However, they are typically short-lived and are followed by a reversal or a return to the original trend.

Traders should be aware of fake-out chart patterns and use caution when entering trades based on these patterns. It is important to use a combination of analysis tools, such as technical chart patterns, fundamental analysis, and leading and lagging indicators, to increase the chances of identifying and avoiding fake out chart patterns.