Auto trading is a feature that is available on some online brokerages and trading platforms. It allows traders to automatically place trades based on pre-determined criteria. There are many different features that can be found with auto trading.

Some of the most popular ones include the ability to set stop-losses, take-profits, and trailing stops. There are also more advanced features such as risk management and portfolio diversification. In this blog post, we will take a look at some of the different features that are available with auto trading. We will also discuss some of the pros and cons of using this type of trading.

What is Auto Trading?

Auto trading is a feature that allows you to automatically place trades with your broker based on certain conditions. This can be helpful if you don’t have the time or expertise to trade manually. Auto trading can also be useful if you want to take advantage of market opportunities that you may not have time to act on yourself.

There are a few things to consider before using auto trading, such as whether your broker offers the feature and what types of conditions you can set. You should also make sure that you understand how auto trading works and back-test any strategies before using them live.

If you’re interested in auto trading, be sure to check out our list of the best brokers for auto trading.

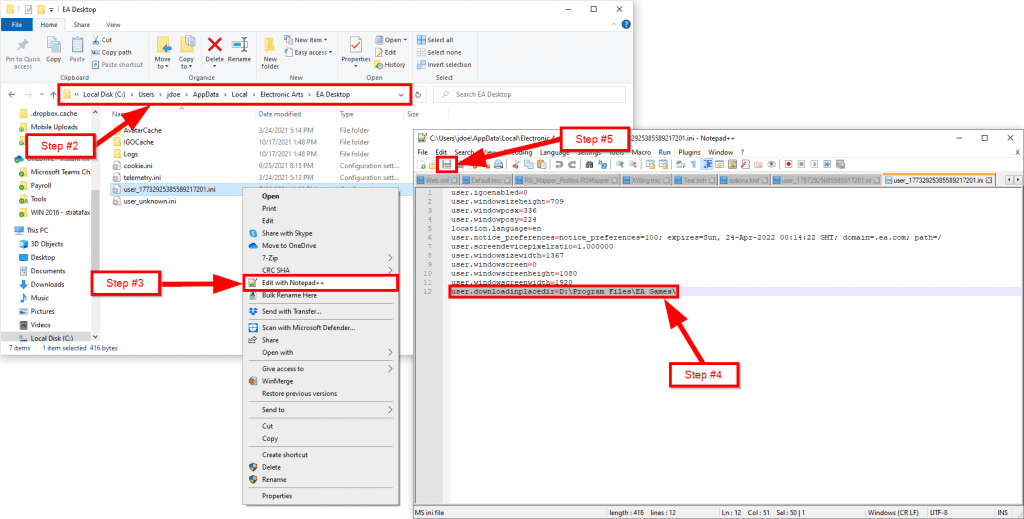

How to install EA (Auto trading system)

If you are looking for a way to automate your trading, EA may be the answer. EA is short for expert advisor, and these are programs that can trade on your behalf. While there are many different EAs available, they all work in a similar manner.

Here is how to install EA on your computer:

1) Download the EA files from the internet. There are many websites that offer EAs for sale or for free.

2) Extract the files to a folder on your computer. Most EAs come in a ZIP file, so you will need to use a program like WinZip or 7-Zip to extract them.

3) Open your MetaTrader platform. This is the software that you use to trade Forex. If you don’t have it already, you can download it from the broker’s website where you open your trading account.

4) Open the “Expert Advisors” folder inside MetaTrader. You will find this folder under “File > Open Data Folder” in the menu bar.

5) Copy the extracted EA files into this folder.

6) Restart MetaTrader. The EA should now appear in the list of available expert advisors in the “Navigator” window on the left side of the platform.

7) Drag the EA from the list and drop it onto a chart to attach it to that chart.

How to execute EA (Auto trading system on charts

To execute an EA or automated trading system on charts, the user must first have a strategy. The strategy should be tested on historical data to ensure that it is profitable. Once the strategy is profitable, the user can then set up the EA with their broker. The EA will then trade according to the rules of the strategy.

Which strategy is the best for an auto trading system?

There are a few different strategies that can be used when it comes to auto trading systems.

Some common ones include:

1) The Martingale Strategy: This is a popular strategy that is used by many traders. It is based on the idea of doubling your trade size after a loss so that you will eventually make up for all of your losses and end up in profit.

2) The Fibonacci Strategy: This strategy is based on the Fibonacci sequence and uses a series of numbers to determine how much to trade.

3) The Trend following Strategy: This strategy looks for trends in the market and then tries to follow them.

Which strategy is the best for an auto trading system?

This is a difficult question to answer as it depends on your personal preferences and what you are looking to achieve with your trading. Some people prefer the martingale strategy as it can produce quick results, while others prefer the trend-following strategy as it can lead to more consistent profits over time. Ultimately, it is up to you to decide which strategy is best for you and your trading goals.

(1) Time-Series Momentum/Mean Reversion

Time-series momentum is a trading strategy that bets on the continuation of existing trends in the market. The strategy buys assets that have been rising in price and sells assets that have been falling in price.

Mean reversion is a trading strategy that bets on the reversal of existing trends in the market. The strategy buys assets that have been falling in price and sells assets that have been rising in price.

Both time-series momentum and mean reversion are popular strategies among traders who use automated trading systems.

(2) Cross-Sectional Momentum/Mean Reversion

One of the features of auto trading is cross-sectional momentum, or mean reversion. This is a strategy that looks at the difference in performance between two asset classes and goes long the outperforming asset and short the underperforming asset. The idea is that over time, the outperformance will reverse and the strategy will make money from this mean reversion.

This strategy can be used on any two asset classes but is most commonly used on stocks and bonds. It is a popular strategy because it has been shown to be effective in both bull and bear markets. Additionally, it does not require a lot of capital to get started, as only two positions need to be taken.

There are a few things to keep in mind when using this strategy. First, it is important to have a clear idea of what the underlying thesis is for why one asset class is going to outperform another. Second, this strategy requires patience as it can take some time for the outperformance to reverse. Finally, it is important to monitor the positions closely and have exit plans in place in case the outperformance continues longer than expected.

(3) Dollar Cost Averaging

Dollar-cost averaging is an investing technique whereby the investor purchases a fixed dollar amount of a particular investment on a regular schedule, regardless of the share price. The idea behind dollar cost averaging is to reduce the effects of volatility on the overall investment and to take advantage of lower prices during periods of market downturns. When done correctly, dollar cost averaging can help to smooth out the ups and downs of the market and can be a useful tool for long-term investors.

(4) Market Making

Market making is the process of creating and maintaining a market for a particular security. Market makers are typically large banks or investment firms that buy and sell securities on their own accounts, in order to provide liquidity to the market.

When it comes to auto trading, market-making can be a useful tool. By providing liquidity to the market, market makers can help to ensure that prices stay stable and that trades are executed smoothly. In addition, by buying and selling securities on their own account, market makers can provide valuable information about the market to traders.

(5) Day Trading Automation

Automated trading, also known as algorithmic trading or black-box trading, is the use of computer programs to make trading decisions for you. These programs follow a set of rules or an algorithm, which is why they are also sometimes called “robots.”

Some people think that automated trading takes the emotion out of decision-making. After all, a robot is not going to get upset if it loses money on a trade or happy if it makes a lot of money.

Others worry that automated systems may be susceptible to fraud or manipulation since there is no human intervention.

Still, many traders find that using an automated system can save them time and take away some of the stress of day trading.

this content has always helped me in learning. thanks for these useful pieces of information