What Does It Mean by Leading Indicators?

Leading indicators in Forex trading are indicators that can predict future price movements or trends. These indicators are typically based on data that is collected and analyzed ahead of the actual price movement, and they are used to anticipate future price movements or trends.

Some examples of leading indicators in Forex trading include the Moving Average Convergence Divergence (MACD) indicator, the Relative Strength Index (RSI) indicator, and the Stochastic Oscillator. These indicators can be used to identify potential trading opportunities, as well as to confirm existing trends or to alert traders to potential reversals.

Leading indicators are often used in conjunction with other analysis tools, such as technical chart patterns or fundamental analysis, to provide a more comprehensive view of the market and to increase the chances of successful trades. However, it is important to note that leading indicators are not always accurate, and traders should use them in conjunction with other analysis tools to increase the chances of success.

Major Leading Indicators Commonly Used in Meta Trader 4&5

Some of the major leading indicators in MetaTrader 4 (MT4&5) are:

- Moving Average Convergence Divergence (MACD): This indicator uses the relationship between two moving averages to measure the strength of a trend.

- Relative Strength Index (RSI): This indicator measures the strength of a trend by comparing the magnitude of recent gains to recent losses.

- Stochastic Oscillator: This indicator measures the momentum of a trend by comparing the closing price to the range of prices over a given period.

- Parabolic SAR: This indicator uses a series of dots to indicate potential trend reversals.

- CCI (Commodity Channel Index): This indicator measures the deviation of a security’s price from its statistical mean.

- Moving Average: This is an indicator commonly used in technical analysis, used to help smooth out price data by creating a constantly updated average price. A rising moving average indicates that the security is in an uptrend, while a declining moving average indicates a downtrend

- Bollinger Bands: This indicator uses a moving average and standard deviation to create upper and lower bands around the price, indicating potential trend reversals.

- Ichimoku Kinko Hyo: This is a technical indicator that is used to gauge momentum along with future areas of support and resistance. The all-in-one technical indicator is comprised of five lines called the tenkan-sen, kijun-sen, senkou span A, senkou span B, and chikou span.

- Fibonacci Retracement: The Fibonacci retracement tool plots percentage retracement lines based on the mathematical relationship within the Fibonacci sequence. These retracement levels provide support and resistance levels that can be used to target price objectives.

Fibonacci Retracements are displayed by first drawing a trend line between two extreme points. A series of six horizontal lines are drawn intersecting the trend line at the Fibonacci levels of 0.0%, 23.6%, 38.2%, 50%, 61.8%, and 100%.

Major Leading Indicators

- Super Trend: A Super Trend is a trend following an indicator similar to moving averages. It is plotted on price and the current trend can simply be determined.

- Williams’s %R: This indicator measures the overbought or oversold condition of a security by comparing the current closing price to the high and low prices over a given period.

- Trend Line: A trend line is a line drawn over pivot highs or under pivot lows to show the prevailing direction of price. Trend lines are a visual representation of support and resistance in any time frame. They show the direction and speed of price, and also describe patterns during periods of price contraction.

- Custom indicators: Custom indicator is a program independently developed in MetaQuotes Language 4 by the user and functioning as a technical indicator. A technical indicator is a mathematical transformation of security price and/or volume in order to forecast future price changes.

These indicators can be found in the MT4&5 platforms under the “Insert” tab and then selecting “Indicators.” It is important to note that these indicators should be used in conjunction with other analysis tools, such as technical chart patterns or fundamental analysis, to provide a more comprehensive view of the market and increase the chances of successful trades.

Which is the best leading indicator in Meta trader 4 and 5?

It is difficult to determine which is the best leading indicator in MetaTrader 4 (MT4) and MetaTrader 5 (MT5) as different indicators may work better in different market conditions and for different traders. Some traders may prefer one indicator over another based on their individual trading style and strategy.

That being said, some popular leading indicators in MT4 and MT5 include the Moving Average Convergence Divergence (MACD), the Relative Strength Index (RSI), and the Stochastic Oscillator. These indicators are widely used and can be effective in identifying potential trading opportunities and confirming trends.

Ultimately, the best leading indicator is the one that works best for a particular trader’s needs and goals. It is important to test out different indicators and see which one provides the most accurate signals for a given trader’s strategy. Some leading indicator works better for currency pairs while other works best for commodity or indices.

What is Lagging Indicator?

Lagging indicators in MetaTrader are indicators that are based on historical data and are used to confirm trends or to identify potential trend reversals. These indicators are typically slower to respond to price movements compared to leading indicators, as they are based on data that has already occurred.

Some examples of lagging indicators in MetaTrader include the Moving Average, the Average Directional Index (ADX), and the Fibonacci retracement levels. These indicators are used to confirm trends that are already in progress or to identify potential trend reversals.

Lagging indicators are often used in conjunction with other analysis tools, such as technical chart patterns or fundamental analysis, to provide a more comprehensive view of the market and to increase the chances of successful trades. However, it is important to note that lagging indicators are not always accurate, and traders should use them in conjunction with other analysis tools to increase the chances of success.

Major Lagging Indicators Commonly Used in Meta Trader 4&5

Some major lagging indicators in MetaTrader 4 (MT4) include:

- Moving Average: This indicator uses a series of averages of past prices to smooth out price action and identify trends.

- Average Directional Index (ADX): This indicator measures the strength of a trend by comparing the difference between the high and low prices over a given period.

- Fibonacci retracement levels: This indicator uses horizontal lines to indicate areas where the price may potentially reverse based on the Fibonacci sequence.

- Bollinger Bands: This indicator uses a moving average and standard deviation to create upper and lower bands around the price, indicating potential trend reversals.

- CCI (Commodity Channel Index): This indicator measures the deviation of a security’s price from its statistical mean.

- Parabolic SAR: This indicator uses a series of dots to indicate potential trend reversals.

- Williams %R: This indicator measures the overbought or oversold condition of a security by comparing the current closing price to the high and low prices over a given period.

- Average Volume: You can calculate the volume moving average, a time period of a minimum of 14 days to weeks. It is measured by taking a specified period in the crypto chart and dividing it by the number of bars in that same period.

It is important to note that these indicators should be used in conjunction with other analysis tools, such as technical chart patterns or fundamental analysis, to provide a more comprehensive view of the market and to increase the chances of successful trades.

Which is the best lagging indicator in Meta trader 4 and 5?

It is difficult to determine which is the best lagging indicator in MetaTrader 4 (MT4) and MetaTrader 5 (MT5) as different indicators may work better in different market conditions and for different traders. Some traders may prefer one indicator over another based on their individual trading style and strategy.

That being said, some popular lagging indicators in MT4 and MT5 include the Moving Average, the Average Directional Index (ADX), and the Fibonacci retracement levels. These indicators are widely used and can be effective in confirming trends that are already in progress or in identifying potential trend reversals.

Ultimately, the best lagging indicator is the one that works best for a particular trader’s needs and goals. It is important to test out different indicators and see which one provides the most accurate signals for a given trader’s strategy.

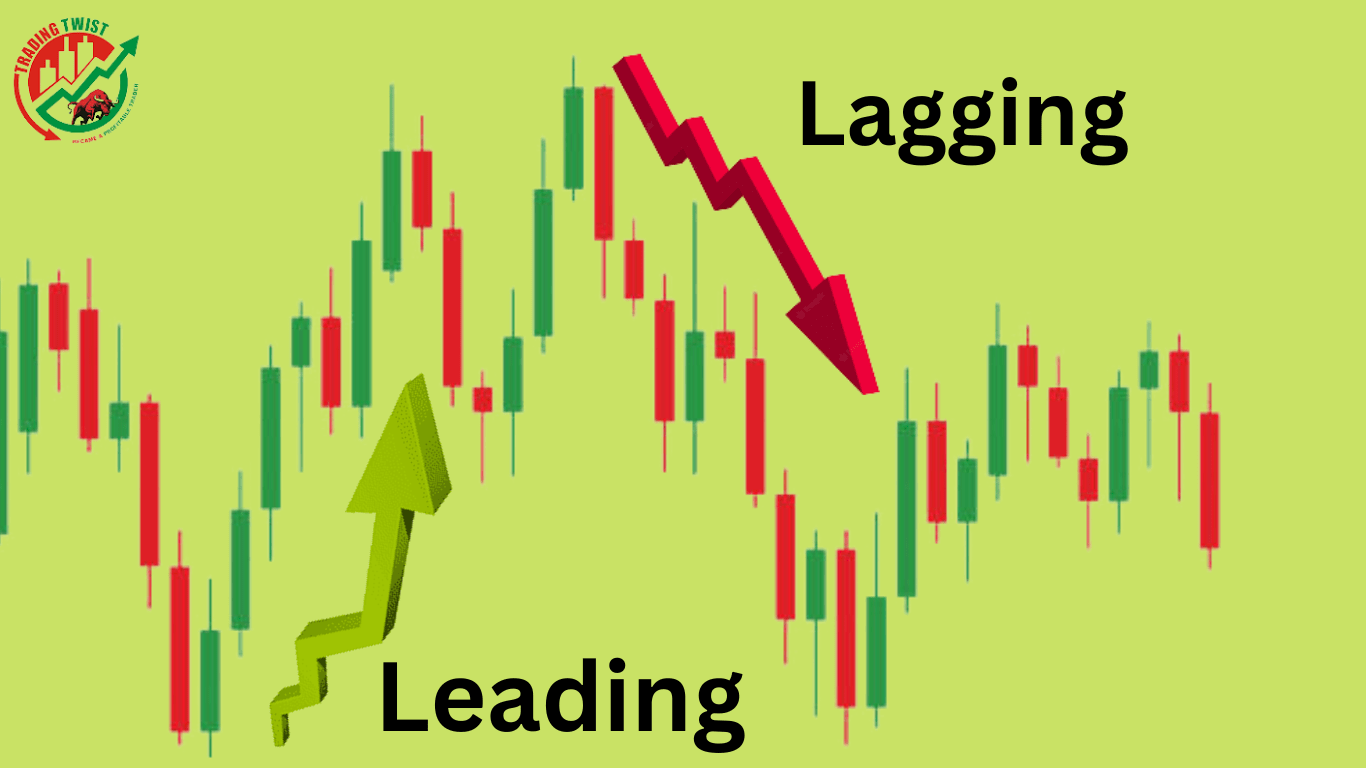

Difference between leading and lagging indicators in Forex trading

Leading indicators in Forex trading are indicators that can predict future price movements or trends. These indicators are typically based on data that is collected and analyzed ahead of the actual price movement, and they are used to anticipate future price movements or trends. Examples of leading indicators include the Moving Average Convergence Divergence (MACD) indicator and the Stochastic Oscillator.

Lagging indicators in Forex trading are indicators that are based on historical data and are used to confirm trends or to identify potential trend reversals. These indicators are typically slower to respond to price movements compared to leading indicators, as they are based on data that has already occurred. Examples of lagging indicators include the Moving Average and the Average Directional Index (ADX).

The main difference between leading and lagging indicators is the timing of their signals. Leading indicators provide early signals of potential price movements or trends while lagging indicators provide confirmation of trends that are already in progress or identify potential trend reversals. Both types of indicators can be useful in Forex trading, but they should be used in conjunction with other analysis tools to increase the chances of success.

The best combination of leading and lagging indicators in Forex Trading?

It is difficult to determine the best combination of leading and lagging indicators in Forex trading as different combinations may work better in different market conditions and for different traders. Some traders may prefer to use a combination of leading indicators to anticipate potential price movements, while others may prefer to use a combination of lagging indicators to confirm trends that are already in progress.

That being said, some popular combinations of leading and lagging indicators in Forex trading include:

Moving Average Convergence Divergence (MACD) and Moving Average: The MACD is a leading indicator that uses the relationship between two moving averages to measure the strength of a trend, while the moving average is a lagging indicator that smooths out price action and identifies trends. This combination can be used to anticipate potential trend changes and confirm trends that are already in progress.

Stochastic Oscillator and Fibonacci retracement levels: The Stochastic Oscillator is a leading indicator that measures the momentum of a trend, while the Fibonacci retracement levels are a lagging indicator that uses horizontal lines to indicate areas where the price may potentially reverse. This combination can be used to identify potential trend reversals and confirm trends that are already in progress.

Relative Strength Index (RSI) and Bollinger Bands: The RSI is a leading indicator that measures the strength of a trend by comparing the magnitude of recent gains to recent losses, while Bollinger Bands are a lagging indicator that uses a moving average and standard deviation to create upper and lower bands around the price, indicating potential trend reversals. This combination can be used to identify potential trend changes and confirm trends that are already in progress.

It is important to note that these combinations are just examples, and traders should test out different combinations and see which one works best for their individual trading style and strategy.