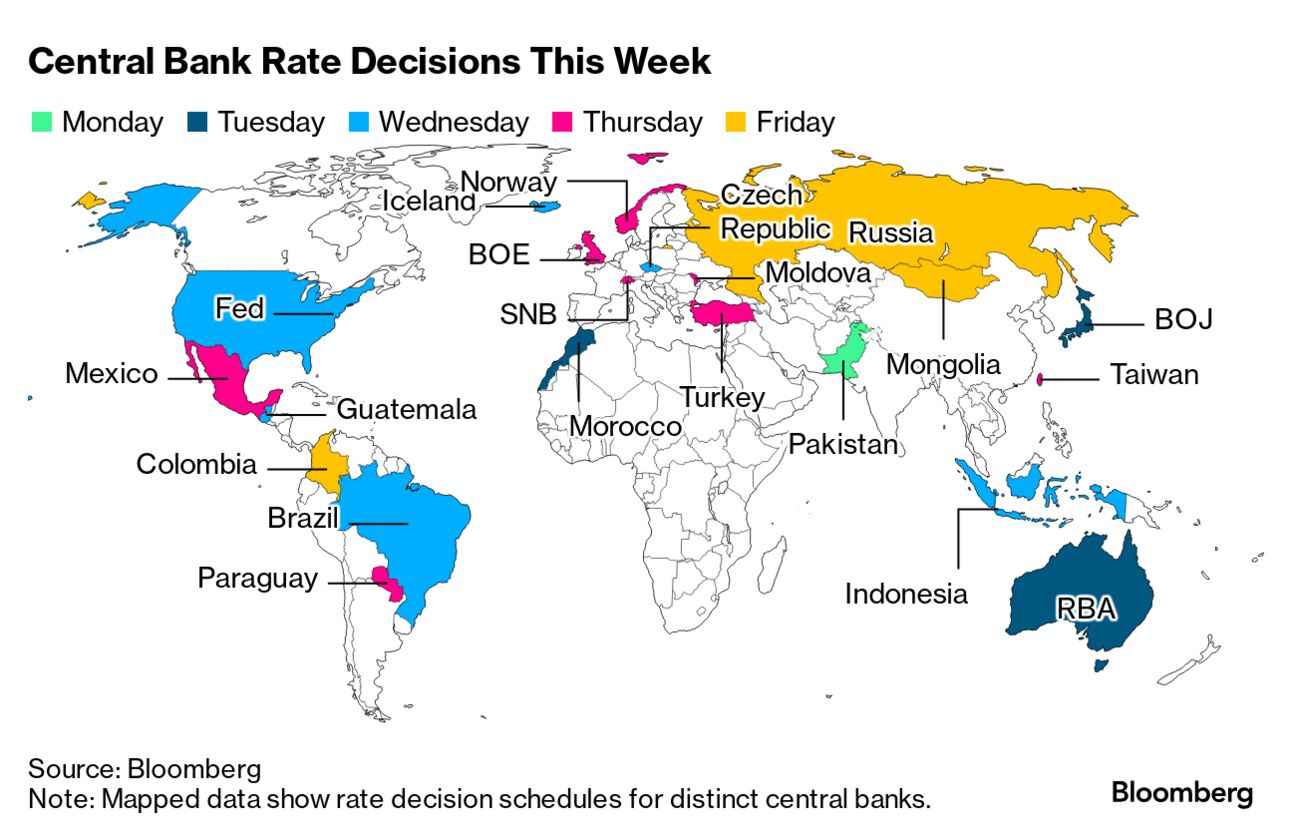

This week’s financial landscape is set to witness dynamic shifts with five pivotal rate decisions on the horizon. Markets are abuzz with anticipation as investors brace themselves for potential seismic movements, particularly from the Federal Reserve (Fed) and the Bank of Japan (BoJ). Here’s a concise breakdown of what to expect:

1. Fed’s Potential Policy Shift: Investors are on edge amid concerns that the Fed may hint at scaling back its rate cuts for the year, given the persistent challenges posed by sticky inflation. The fear of a possible adjustment in the Fed’s stance has sent ripples across markets, impacting currency dynamics.

2. BoJ’s Historic Move: The BoJ is poised to make a significant departure from its longstanding negative interest rate policy, signaling a shift towards normalization. This anticipated move follows Japan’s sustained economic resilience and the looming specter of inflation surpassing the BoJ’s target levels.

3. RBA’s Economic Indicators: Australia’s Reserve Bank (RBA) is expected to maintain its Cash Rate, but attention is drawn to its insights into the economy’s health. With rising unemployment concerns, the RBA may hint at potential future rate adjustments, potentially influencing the Australian Dollar’s trajectory.

4. SNB’s Surprise Factor: The Swiss National Bank (SNB) could spring a surprise by considering a rate cut, deviating from expectations of maintaining the status quo. Switzerland’s inflationary landscape and the SNB’s policy stance will likely impact the Swiss Franc’s performance.

5. BoE’s Dilemma: The Bank of England (BoE) finds itself at a crossroads, torn between divergent opinions within its Monetary Policy Committee (MPC). With the UK facing recessionary pressures and inflation dynamics in flux, the BoE’s decision could shape the Pound Sterling’s movement.

SEO Optimization: As these central banks chart their courses, volatility in the markets is inevitable. Traders must exercise caution, especially during critical announcements from the Fed and the BoJ.

Conclusion: With five central banks dictating market sentiments in a span of fewer than 60 hours, traders must remain vigilant. Each decision holds the potential for both opportunities and risks, making prudent trading strategies paramount. Stay informed, stay agile, and navigate the markets with confidence.

Note: For more insights and expert analysis on navigating the intricacies of these rate decisions, stay tuned for real-time updates and actionable strategies from our team of seasoned traders.