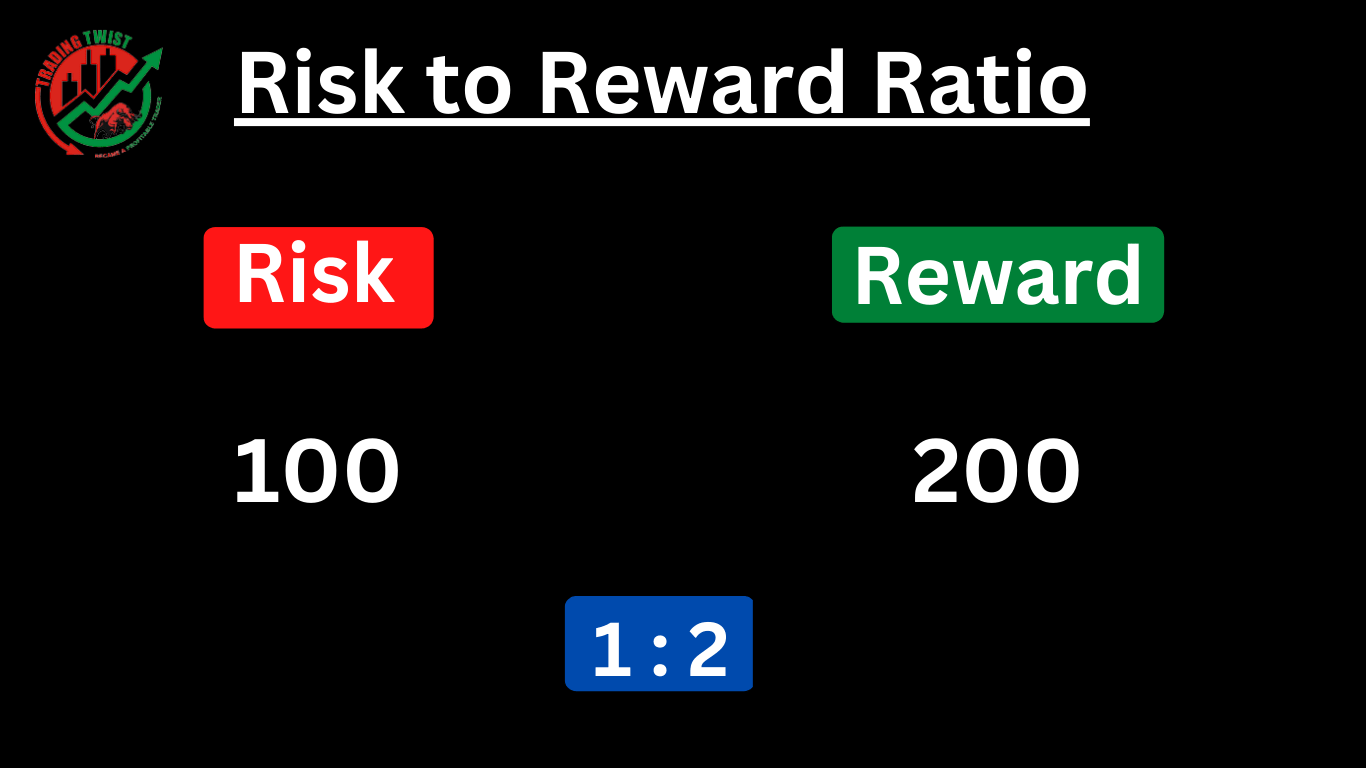

What is risk to reward ratio? It is a measure used in financial trading that compares the potential return of a trade to the amount of risk taken on by the trader. It is calculated by dividing the potential reward of a trade by the potential loss. For example, if a trader is looking to enter a long position and the potential reward is $100 and the potential loss is $50, the risk to reward ratio would be 2:1 (100/50).

In Forex trading it is an important concept because it can help traders determine whether a particular trade is worth taking. If the potential reward of a trade is significantly higher than the potential loss, it will be favorable and the trade may be worth taking. On the other hand, if the potential loss is much higher than the potential reward and will be unfavorable and the trade may not be worth taking.

It’s important to note that it is not a guarantee of success. There is always the risk of losing money in any financial trade, and traders should carefully evaluate their own risk tolerance and financial goals before making any trade decisions.

Importance of Risk to Reward Ratio

It is an important consideration in forex trading because it can help traders determine the potential profitability of a trade. By comparing the potential reward of a trade to the potential loss, traders can gauge whether the trade is worth taking given their risk tolerance and financial goals.

Here are some reasons why the risk to reward ratio is important in forex trading:

- It helps traders manage risk: By focusing on trades with favorable profit and loss, traders can potentially increase their overall profitability by limiting their potential losses.

- It can improve trade performance: A trade with a higher risk to reward ratio has the potential to be more profitable than a trade with a lower one, even if both trades are successful.

- It can increase the probability of success: By focusing on trades with a favorable risk to reward ratio, traders can potentially increase the probability of success for their trades.

- It can help traders make more informed decisions: By considering the in addition to other factors, such as technical analysis and fundamental analysis, traders can make more informed and well-rounded trade decisions.

It’s important to note that the risk to reward ratio is just one factor to consider when making trade decisions, and traders should carefully evaluate their own risk tolerance and financial goals before making any trade decisions.

Different techniques to measure Risk to Reward Ratio:

There are several techniques that traders can use to measure the risk to reward ratio in Forex trading. Here are some common techniques:

- Setting stop-loss and take-profit orders: One way to measure the risk to reward ratio is to set stop-loss and take-profit orders at predetermined levels. The stop-loss order is set at a level where the trader is willing to exit the trade if the market moves against them, while the take-profit order is set at a level where the trader is willing to exit the trade if the market moves in their favor. By dividing the take-profit level by the stop-loss level, traders can calculate the profit and loss for the trade.

- Using the ATR (Average True Range) indicator: The ATR is a technical indicator that measures the volatility of a currency pair. By dividing the ATR by the current market price, traders can calculate the potential reward for a trade. This potential reward can then be divided by the potential loss, which can be determined by setting a stop-loss order at a certain distance from the entry price.

- Using the reward-to-risk ratio: This technique involves dividing the distance between the entry price and the take-profit level by the distance between the entry price and the stop-loss level. This can then be used to determine the trade.

- Risk-based position sizing: Another way to measure this is to use risk-based position sizing. This involves calculating the size of the trade based on the amount of risk that the trader is willing to take on. For example, if a trader is willing to risk 2% of their account balance on a trade with a potential reward of $100 and a potential loss of $50, they can calculate the size of the trade by dividing the potential reward by the risk percentage (100/2%).

- Risk-reward ratio calculator: There are also online tools and calculators available that can help traders calculate the risk to reward ratio for their trades. These tools typically require the trader to input the potential reward and potential loss for the trade, and the calculator will then calculate.

- Risk-reward ratio chart: Some traders use a chart to visualize this for their trades. The chart will typically show the potential reward on the y-axis and the potential loss on the x-axis. This can help traders see at a glance the potential risk and rewards for different trades.

- Risk-reward ratio formula: It can also be calculated using a simple formula. The formula is: Risk to reward ratio = Potential reward / Potential loss.

- Risk-reward ratio indicator: Some technical analysis software and charting platforms include indicators that can help traders measure the risk to reward ratio. These indicators typically plot the potential reward and potential loss on the chart, allowing traders to see the trade at a glance.

- Risk-reward ratio spreadsheet: Some traders use a spreadsheet to track the profit and loss for their trades. The spreadsheet will typically include columns for the potential reward, potential loss, and risk to reward ratio, allowing traders to easily track and compare the profit and loss for different trades.

It’s crucial to remember that no method is necessarily superior to the others, and the ideal strategy will rely on the requirements and preferences of the specific trader.

Which is the Best Risk to Reward Ratio?

There is no one “best” risk to reward ratio in Forex trading. The appropriate trade will depend on the individual trader’s strategy, risk tolerance, and financial goals. Some traders may be comfortable with a higher trade, while others may prefer a lower one.

In general, a higher trade can potentially lead to higher profits, but it also carries a higher risk of loss. On the other hand, a lower may result in smaller profits, but it also carries a lower loss.

Some traders aim for a trade of 1:1, which means that the potential reward is equal to the potential loss. Other traders may aim for a higher, such as 2:1 or 3:1, which means that the potential reward is two or three times the potential loss, respectively.

It’s important to note that this is just one factor to consider when making trade decisions, and traders should carefully evaluate their own risk tolerance and financial goals before making any trade decisions.

How we can increase Profit against Loss?

There are several ways that traders can potentially increase the reward to risk ratio in forex trading:

- Use a wider stop loss: One way to increase the reward to risk ratio is to use a wider stop loss, which is a level at which the trade will be automatically closed if the market moves against the trader. By using a wider stop loss, traders can potentially increase the potential reward for their trade while also increasing the potential loss.

- Use a tighter take profit: Another way to increase the profit and loss ratio is to use a tighter take profit, which is a level at which the trade will be automatically closed if the market moves in favor of the trader. By using a tighter take profit, traders can potentially increase the potential reward for their trade while also decreasing the potential loss.

- Use risk-based position sizing: Traders can also use risk-based position sizing to potentially increase profit and loss. This involves calculating the size of the trade based on the amount of risk that the trader is willing to take on. By taking on more risk, traders can potentially increase the potential reward for their trade while also increasing the potential loss.

- Use a higher risk to reward ratio: Some traders may choose to aim for a higher loss, such as 2:1 or 3:1, which means that the potential profit is two or three times the potential loss, respectively. By aiming for a higher risk-to-reward ratio, traders can potentially increase the potential gain for their trade while also increasing the potential loss.

- Use technical analysis: Traders can also use technical analysis, such as chart patterns and indicators, to potentially increase the ratio. By identifying areas of support and resistance and trend lines, traders can potentially increase the potential reward for their trade while also decreasing the potential loss.

Conclusion

It’s essential to remember that these tactics have inherent dangers and may not always work. Before putting any of these techniques into practice, traders should carefully assess their individual risk appetite and financial objectives.

excellent explanation of the risk to reward ratio.