The foreign exchange market is one of the largest and most liquid markets in the world, with an average daily turnover of more than $5 trillion. But what many people don’t realize is that a large portion of this trading takes place in so-called “minor currency pairs.” Minor currency pairs are those that include a major currency paired with a less widely traded or developing currency. Examples include EUR/GBP, CAD/JPY, and AUD/NZD. While they may not get as much attention as the major pairs, there are actually several good reasons to trade minor currency pairs.

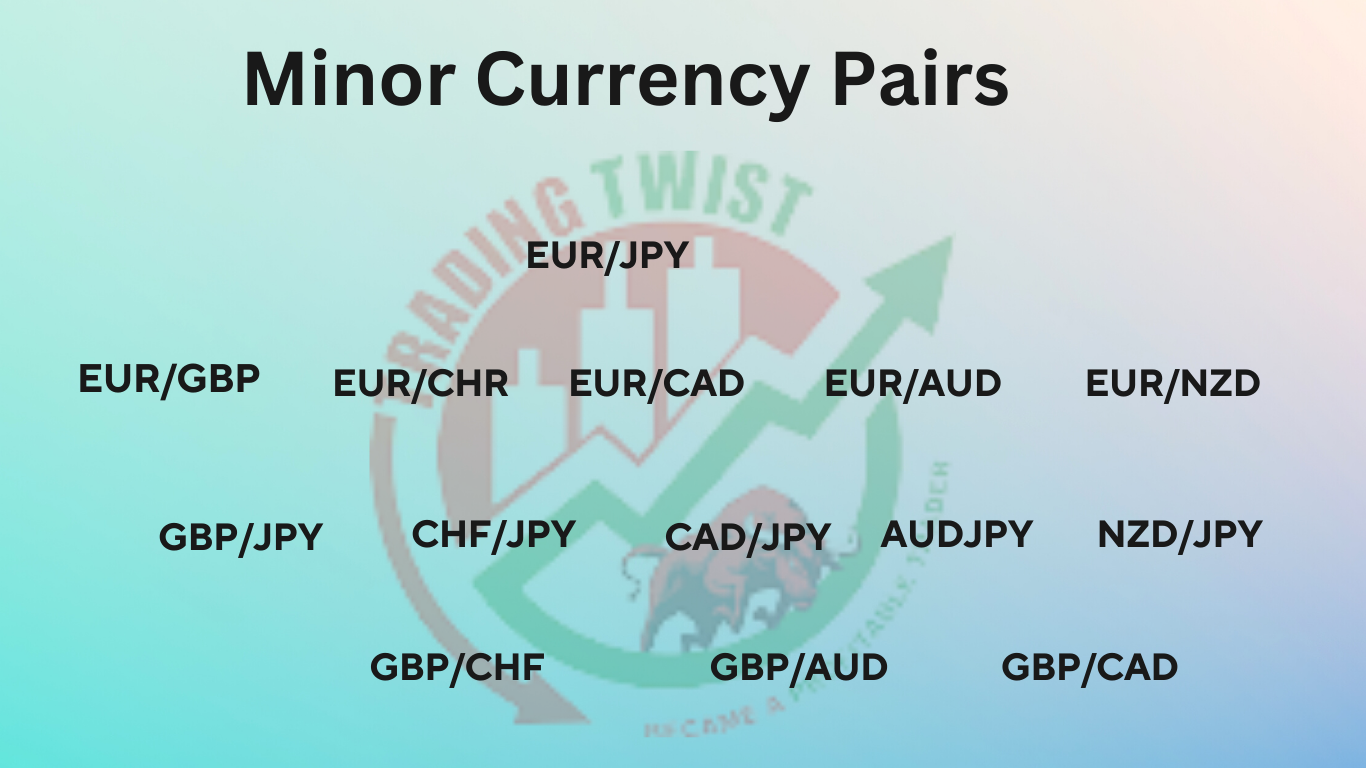

What are Minor Currency Pairs?

Minor currency pairs are those which do not include the US dollar. These pairs are often overlooked by traders, but they can actually offer a number of advantages.

One benefit of minor currency pairs is that they tend to be less volatile than major pairs. This means that they may be more suitable for beginners who are still learning to trade forex. Another advantage is that minor pairs can offer opportunities to profit from global events that may not have a big impact on major currencies.

Of course, there are also some risks associated with trading minor currency pairs. For example, they may be less liquid than major pairs and therefore more difficult to trade. Additionally, small fluctuations in exchange rates can have a bigger impact on these pairs than on major ones.

Overall, minor currency pairs can be a good option for traders who are looking for something different from the majors, or who want to take advantage of global events that may not move the markets much. However, it is important to remember that these pairs come with their own set of risks and should be traded carefully.

Why You Should Trade Them

There are a few key reasons why trading minor currency pairs can be advantageous for traders:

- Increased price action and volatility: Compared to major currency pairs, which tend to be more stable and have less overall volatility, minor currency pairs can offer up more opportunities for active traders to capitalize on.

- Greater market depth: With a larger number of participants trading in the market, there is typically greater market depth available for minor currency pairs, meaning that orders can be filled more easily and at better prices.

- Better risk-reward ratios: In general, due to the increased volatility and depth of the market, minor currency pairs tend to offer better entry and exit points for trades, as well as better risk-reward ratios.

- More diverse opportunity set: By expanding the number of currency pairs that you trade, you can also diversify your opportunity set and potentially reduce your overall risk exposure.

Overall, trading minor currency pairs can provide numerous benefits for active traders looking to take advantage of all that the forex market has to offer.

What to Consider When Trading Minor Currency Pairs

When trading minor currency pairs, there are a few things to consider.

First, minor currency pairs tend to be much more volatile than major currency pairs. This means that they can move very quickly in either direction and that large price swings are not uncommon. This can make them more difficult to trade, as it can be harder to predict which way the market will move.

Second, minor currency pairs tend to have lower liquidity than major pairs. This means that there may be less buying and selling activity in these markets and that it can be more difficult to get in and out of trades.

Third, minor pairs often have wider spreads than major currency pairs. This means that it may cost more to trade these pairs, as the bid-ask spread will be larger.

Finally, some brokerages may not offer all minor currency pairs. This means that you may need to open an account with a different brokerage in order to trade certain pairs.

Overall, there are a few things to consider when trading minor pairs. These include volatility, liquidity, spreads, and availability. By taking these factors into account, you can help ensure that you are able to trade these pairs successfully.

How to Trade Minor Currency Pairs

When it comes to trading forex, most people focus on the major currency pairs. However, there are many opportunities to trade minor currency pairs as well.

Minor currency pairs are those that don’t include the US dollar. For example, EUR/GBP is a minor currency pair because neither the euro nor the British pound is the US dollar.

There are a few reasons why you should trade minor currency pairs:

- There is less competition.

Most forex traders focus on the major currency pairs, so there is less competition when it comes to trading minor currency pairs. This can lead to more opportunities to make profits.

- You can take advantage of global events.

Global events such as political decisions or natural disasters can have a big impact on minor currency pairs. For example, if there is a Brexit deal, this could cause the EUR/GBP to go up or down depending on the details of the deal.

- You can get more bang for your buck.

Minor currencies are often more volatile than major currencies, so you can make bigger profits (or losses) in a shorter period of time. However, this also means that you need to be more careful with your money management and risk management strategies.

Conclusion

If you’re looking for a way to trade currency pairs with low fees and high liquidity, then Minor Currency Pairs are definitely worth considering. Not only do they offer a great opportunity to make profits, but they also provide a fantastic way to diversify your portfolio. So whether you’re a beginner or an experienced trader, Minor Currency Pairs should definitely be on your radar.