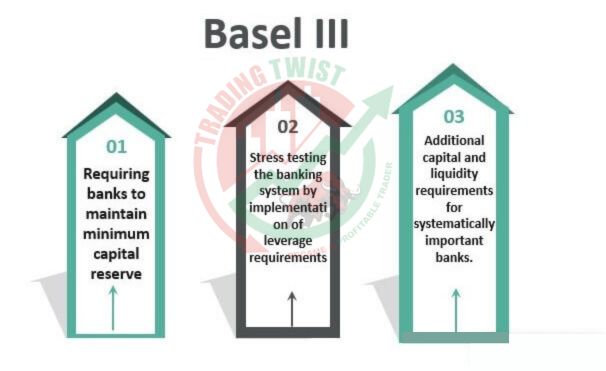

Basel III endgame refers to the final stage of implementation and enforcement of the Basel III framework, a set of international banking regulations established by the Basel Committee on Banking Supervision. This framework aims to enhance the stability and resilience of the global banking system by imposing stricter capital requirements, improving risk management practices, and promoting greater transparency and accountability among financial institutions. As the banking industry progresses toward the culmination of Basel III, understanding its implications becomes crucial for assessing how it will impact the global financial landscape.

The Basel Board on Financial Management (BCBS) reported the conclusion of the Basel III administrative system in December 2017. Notwithstanding, the execution of Basel III has been progressing since its underlying acquaintance accordingly with the 2008 monetary emergency. The particular course of events for the foundation of the Basel III final plan panel isn’t expressly characterized, as it is a finish of endeavors by the BCBS and public administrative specialists to internationally accomplish full consistency with the Basel III norms by banks and monetary establishments.

The critical targets of the Basel Board on Financial Oversight (BCBS) include:

1. Enhancing Capital Requirements:

Basel III presents higher least capital necessities, including normal value Level 1 capital, to guarantee that banks keep up with adequate capital support to endure monetary shocks and market slumps.

How much capital banks keep up with adequate capital cradles to endure monetary shocks and markets is not entirely set in stone by administrative prerequisites set out by banking specialists like the Basel Council on Financial Oversight (BCBS) and public administrative bodies.

Under the Basel III framework, banks are required to maintain several layers of capital, including:

A: Typical Value Level 1 (CET1) Capital:

This is the greatest capital, comprising basically of normal value shares and held income. CET1 capital fills in as the center capital base of banks and is intended to retain misfortunes during times of monetary pressure.

B: Extra Level 1 Capital:

This incorporates instruments, for example, unending non-total favored shares and different instruments that give extra misfortune retaining limit.

C: Level 2 Capital:

Level 2 capital contains instruments, for example, subjected obligation and advance misfortune holds, which strengthen cash flow to retain misfortunes.

The particular capital prerequisites differ contingent upon elements like the size, intricacy, and chance profile of the bank, as well as administrative principles set by public specialists.

One key measure used to evaluate capital sufficiency is the Capital Sufficiency Proportion (Vehicle), which looks at a bank’s cash flow to its gamble-weighted resources. The Vehicle is commonly communicated as a rate and should meet or surpass administrative essentials set by banking specialists.

For instance, under Basel III, banks are expected to keep a base CET1 capital proportion of 4.5%, a Level 1 capital proportion of 6%, and an all-out capital proportion of 8%, with extra capital support for foundationally significant banks.

Notwithstanding the least capital prerequisites, controllers may likewise force capital additional charges on foundationally significant banks to address fundamental gambles and guarantee more prominent strength to monetary shocks.

By and large, how much capital banks keep up with as adequate support to endure monetary shocks and market slumps is dependent upon administrative principles and progressing observation by banking specialists to guarantee the well-being and sufficiency of the monetary framework.

2. Improving Gamble The board:

The structure plans to improve the risk the board rehearses inside banks by expecting them to lead more thorough appraisals of their capital ampleness, liquidity hazard, and influence.

3. Mitigating Foundational Chance:

Basel III tries to decrease foundational risk in the monetary framework by forcing stricter guidelines on enormous, all-around-the-world dynamic banks, including extra capital charges and upgraded management.

Alleviating foundational risk in the financial area frequently includes forcing extra capital additional charges and improved oversight on fundamentally significant banks (SIBs). The objective is to lessen the likelihood of SIBs encountering pain or disappointment, which could meaningfully affect the more extensive monetary framework. The particular measure of extra capital charges and the degree of improved management expected to alleviate fundamental gamble can fluctuate contingent upon variables like the size, intricacy, interconnectedness, and worldwide impression of the bank.

Basel Board on Financial Oversight (BCBS)

Under the Basel III administrative structure, which incorporates measures pointed toward moderating foundational risk, the Basel Board on Financial Oversight (BCBS) presented the accompanying key components:

- Capital Extra Charge for Foundationally Significant Banks (SIBs): The BCBS laid out a structure for distinguishing and classifying banks as internationally fundamentally significant banks (G-SIBs) and relegating them to higher capital extra charges given their fundamental significance. G-SIBs are sorted into various cans, each related to a particular capital extra charge that mirrors the bank’s fundamental significance. These capital extra charges are intended to guarantee that G-SIBs keep up with extra misfortune engrossing ability to alleviate the dangers they pose to the monetary framework.

- Upgraded Administrative Structure: notwithstanding higher capital extra charges, SIBs are likely to improve administrative prerequisites and closer administrative investigation. Administrative specialists might force more severe prudential principles, direct more regular and serious administrative appraisals, and expect SIBs to create and keep up with strong gambles the executives rehearse, emergency courses of action, and healing and goal systems. Improved oversight means fortifying the flexibility of SIBs, upgrading their gamble to the executive’s abilities, and diminishing the probability of fundamental disappointments.

The particular measure of extra capital charges and the degree of upgraded management are still up in the air by administrative specialists in light of an extensive evaluation of each bank’s fundamental significance, risk profile, and effect on the monetary framework. These actions are expected to address the dangers presented by SIBs and improve the solidness and flexibility of the worldwide financial framework.

- Addressing Liquidity Hazard: Basel III presents liquidity inclusion proportion (LCR) and net stable financing proportion (NSFR) necessities to guarantee that banks keep up with sufficient liquidity levels to meet their present moment and long-haul subsidizing needs.

- Enhanced Market Discipline: Basel III advances more prominent straightforwardness and divulgence by expecting banks to give more complete data on their gamble openings, capital sufficiency, and liquidity positions. This expanded straightforwardness empowers market members to pursue more educated choices and advances the market discipline.

- Impact on Loaning and Monetary Development: Pundits contend that the severe capital and liquidity necessities under Basel III could prompt diminished loaning by banks, especially to small and medium-sized ventures (SMEs) and different borrowers. This expected decrease in credit accessibility could affect monetary development and speculation movement in certain areas.

- Global Harmonization of Guidelines: Basel III advances more noteworthy consistency and harmonization of administrative norms across nations, working with a level battleground for banks working in various locales. In any case, varieties in the execution and understanding of Basel III guidelines by public controllers might prompt administrative exchange and lopsided consistency.

- Promoting Security and Versatility: By fortifying capital and liquidity necessities, Basel III intends to advance monetary strength and flexibility, decrease the probability of bank disappointments, and alleviate the effect of monetary emergencies on the worldwide economy.

Conclusion

The final plan of Basel III includes the full execution and consistency of its arrangements by banks and monetary foundations around the world. This cycle commonly includes staged execution for quite a while to permit banks to slowly conform to the new prerequisites. Administrative specialists screen and survey banks’ advancement towards accomplishing full consistency with Basel III norms.

It means quite a bit to note that Basel III keeps on developing, with continuous updates and modifications by the Basel Panel to address arising dangers and weaknesses in the financial area. In that capacity, the final stage of Basel III addresses a continuous course of reinforcing administrative principles and upgrading the versatility of the worldwide financial framework.