A lot of forex traders are confused about what is price action, how to trade it, and how to read it. All this confusion stems from not understanding the term itself. Let’s get started with the definition: In trading, price action refers to the collective movement or change in prices of a financial instrument over time. In order to make sense of it, traders have developed a number of technical indicators that help them identify when trends are likely to be strong or weak.

what is the market telling you?

Price action is one of the most important concepts in forex trading. It is the basis for all technical analysis and can be used to make informed trading decisions.

Price action is simply the movement of price on a chart. It can be represented as a line, candlestick, or bar chart. Price action reflects the underlying supply and demand in the market and can be used to identify trading opportunities.

Technical analysts use forex price action to identify trends and support and resistance levels. By studying price action, traders can make informed decisions about when to enter or exit a trade.

Many traders focus exclusively on price action when making trading decisions. This approach can be successful if done correctly. However, it is important to keep in mind that price action is just one tool that should be used in conjunction with other technical indicators and fundamental analysis.

Step 1: Draw support and resistance levels

When it comes to trading forex, price action refers to the act of reading and analyzing the candlestick formations on a price chart in order to make informed trading decisions. In other words, by looking at the candlesticks, we can get an idea of where the market is heading and make trades accordingly.

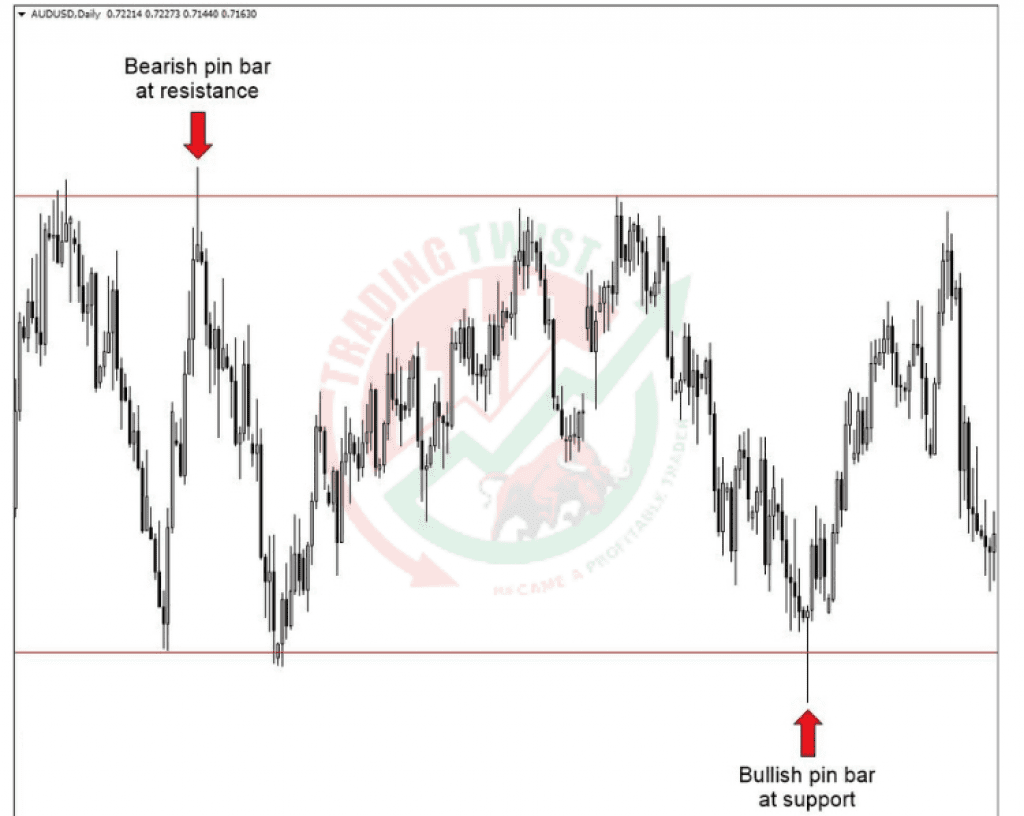

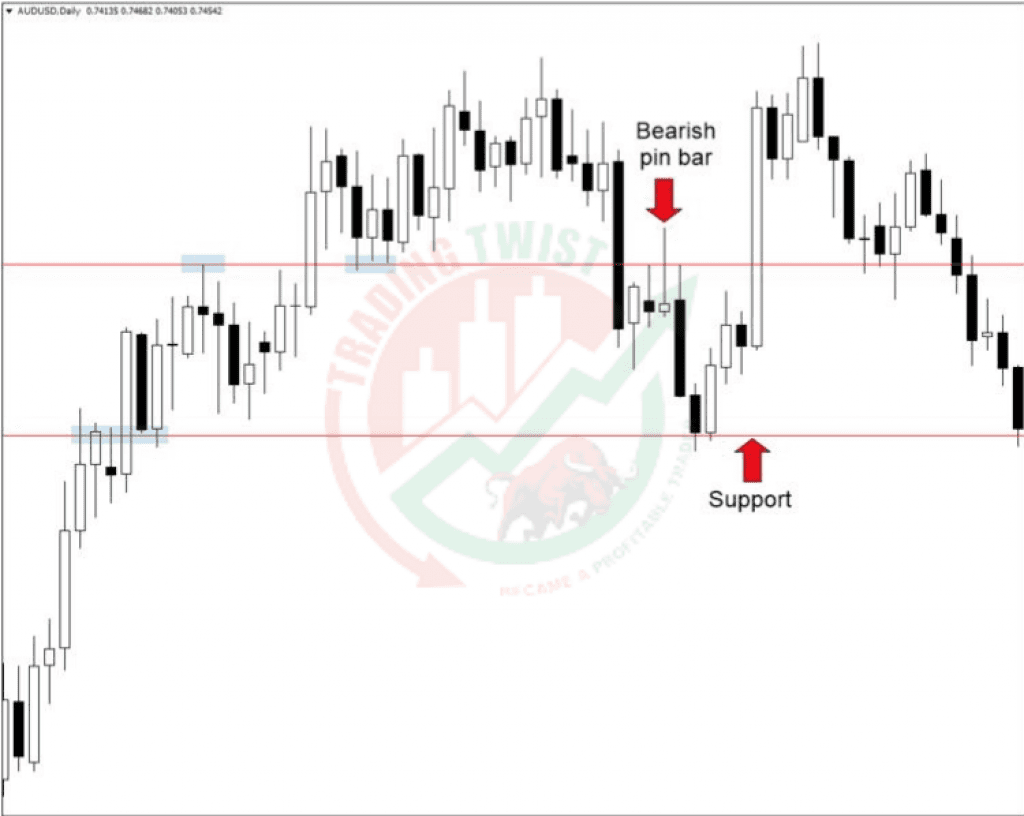

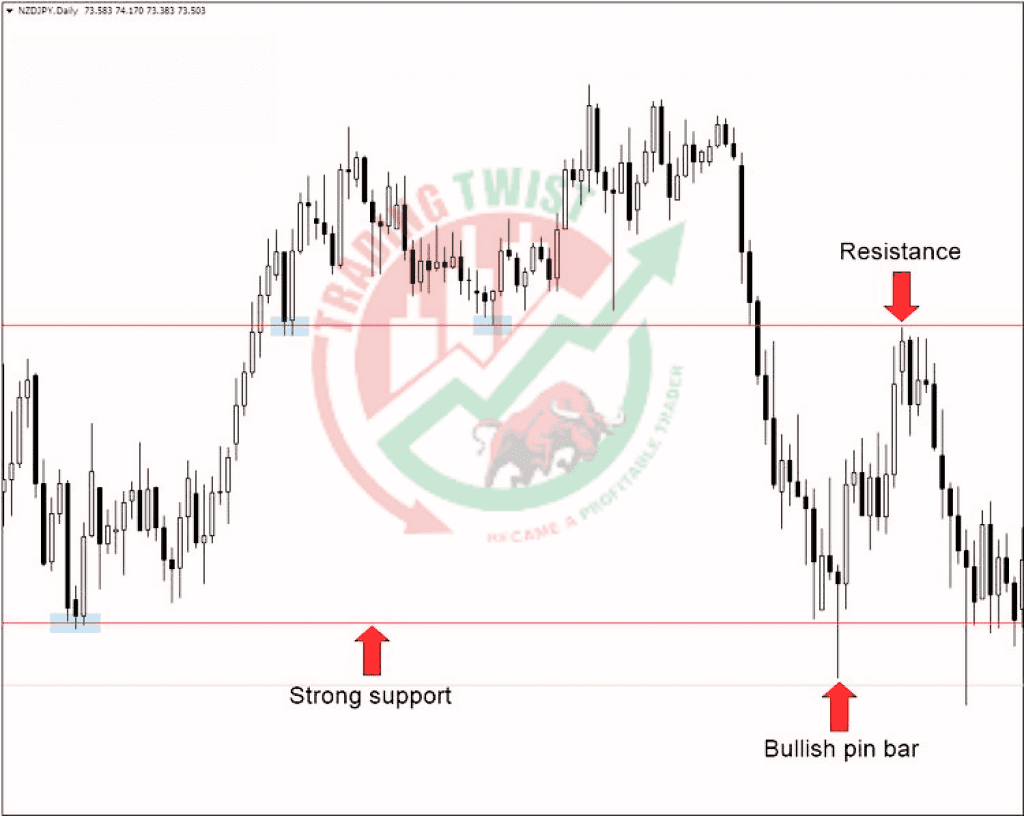

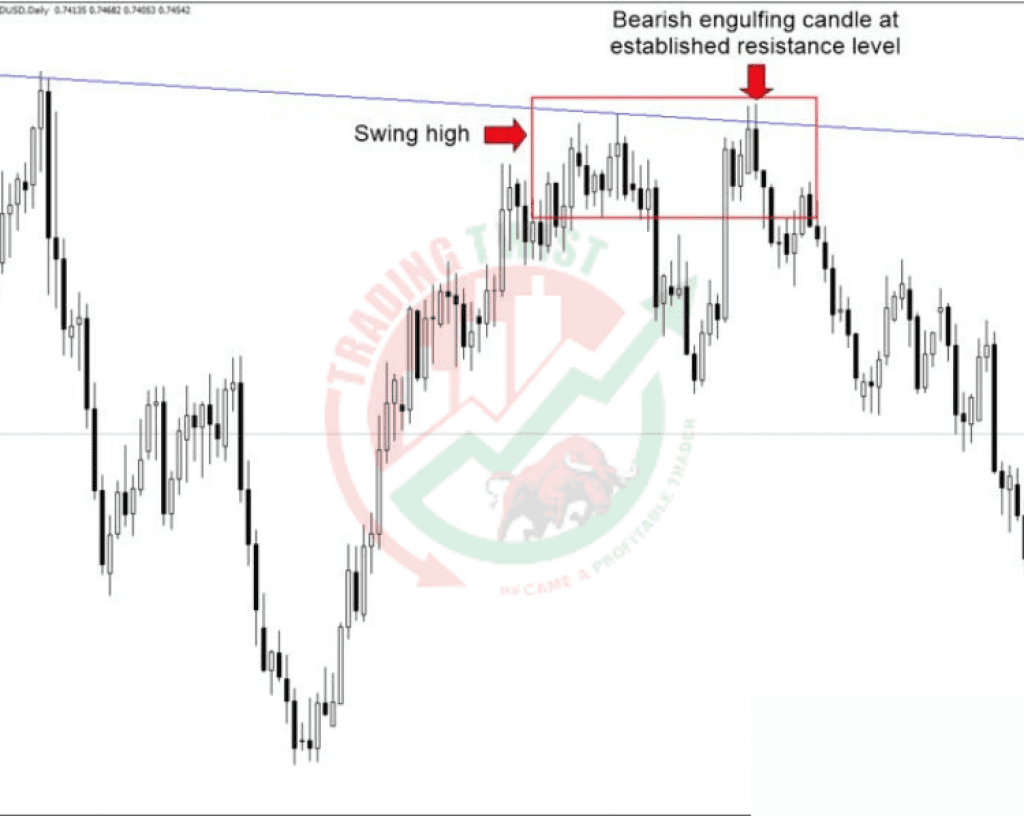

One of the first things you need to do when using price action is to identify support and resistance levels. Support and resistance levels are essentially prices at which the market has a tendency to reverse direction. By identifying these levels, you can make better-informed trading decisions.

To draw support and resistance levels, you will need to use a bit of discretion. The most important thing is to look for areas on the chart where there has been a significant change in price direction. For example, if the market was previously in an uptrend but then suddenly reversed direction and started heading downward, this would be an area of potential resistance. Similarly, if the market was previously in a downtrend but then started abruptly moving upwards, this could be an area of potential support.

Once you have identified potential support and resistance levels, you can then start planning your trades around them. If you see that the market is approaching a level of resistance, you might want to consider selling (or shorting) as this could be an opportunity for profit. Likewise, if the market is approaching a level of support, you might want to consider buying (or going long) as this

Step 2: Wait for the daily session to close

Assuming you are referring to trading forex markets, most price action trading strategies require you to wait for the daily session to close before taking a trade.

This is because the market can be quite volatile during the day and many price action signals can be False breakouts or whipsaws.

By waiting for the close of the daily session, we eliminate much of this volatility and increase the chances that our trade will be a winner.

Step 3: Watch for price action buy and sell signals

In order to trade price action effectively, you need to be able to read and interpret signals from the market. There are two main types of price action signals: buy signals and sell signals.

Buy signals occur when the market is starting to move up, and indicate that prices are likely to continue rising. Sell signals occur when the market is starting to move down, and indicate that prices are likely to continue falling.

To identify buy and sell signals, you need to look for certain price patterns on your charts. Some common price patterns that can give rise to buy or sell signals include:

-Head and shoulders: This pattern occurs when the market forms a peak, followed by a lower high, and then another lower low. The head and shoulders pattern is considered a bearish signal, as it indicates that the market is likely to continue falling.

-Double top: This pattern occurs when the market forms two consecutive highs at roughly the same level. The double-top pattern is considered a bearish signal, as it indicates that the market is unlikely to move higher from here.

-Triple top: This pattern occurs when the market forms three consecutive highs at roughly the same level. The triple-top pattern is considered a very bearish signal, as it indicates that the market is extremely unlikely to move higher from here.

What is Price Action to Evaluate Momentum?

Price action can be used to identify trends, momentum, and reversals. Price action trading is a type of technical analysis that looks at the movement of price over time to make decisions.

There are three main ways to trade forex using price action:

1) Trend trading: looking for markets that are in an overall uptrend or downtrend and then riding that trend;

2) Momentum trading: looking for markets that are making strong moves in one direction and trying to ride that momentum; and

3) Reversal trading: looking for markets that are reversing from an uptrend to a downtrend or vice versa.

Which of these approaches you take will depend on your own trading style and risk tolerance. Some traders like to trade all three styles, while others prefer to focus on just one or two. No matter which approach you take, it is important to have a solid understanding of price action before you begin trading.

Are you listening

Price action trading is a methodology that uses price movement to make trading decisions. It is based on the idea that prices move in trends and that these trends can be identified and used to make profitable trades.

There are a number of ways to trade using price action, but one of the most popular is to look for support and resistance levels. These are areas where prices have been rejected in the past and are likely to do so again. By identifying these levels, traders can enter into trades when prices are at or near these levels, with the expectation that they will continue to move in the same direction.

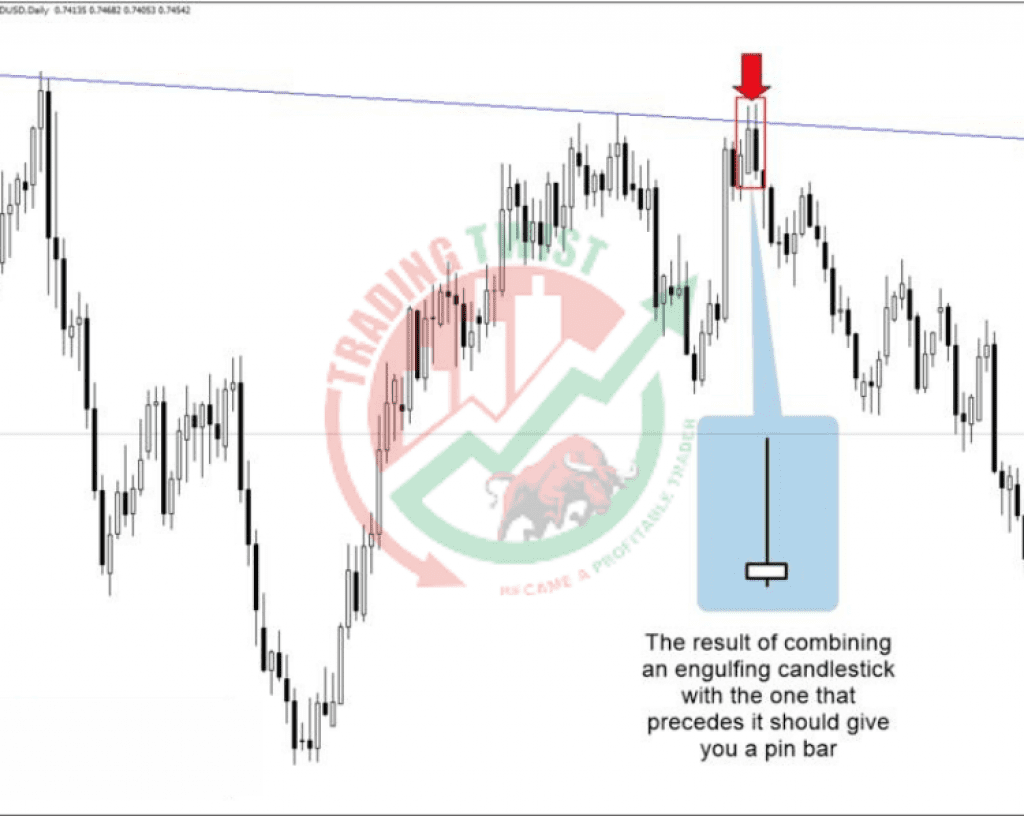

Another popular way to trade using price action is to look for candlestick patterns. These are specific formations that prices make on their chart that can signal a change in direction. By identifying these patterns, traders can enter into trades when these patterns form, with the expectation that prices will move in the direction indicated by the pattern.

There are many other ways to trade using price action, but these are two of the most popular. If you want to learn more about how to trade using this method, there are many resources available online and in books.

Final Words

Price action is the movement of a security’s price. Price action can be used to identify trends, entries, and exits, and to make better trading decisions.

When it comes to Forex trading, you need to be able to read and interpret price action in order to be successful. There are many different ways that you can do this, but one of the most popular methods is using candlestick charts.

Candlestick charts show the open, high, low, and close for a given period of time. They are often used by traders to get an idea of where the market is heading.

If you want to trade successfully, you need to be able to read and understand price action. By using candlestick charts, you can get a better understanding of what is happening in the market and make better trading decisions.

Your Turn: Ask Justin Anything

I’d love for this new weekly Q&A to be successful and provide an invaluable repository of answers to common Forex questions.

To do that, I need your help.

Here’s what you can do to get involved and have your question answered in next week’s post:

- Ask questions. Post them in the comments below or Message them to me Muhammad Shahzad Mirza

- Help me answer questions. If I missed something or if you have something to add, don’t hesitate to leave a comment below.