Trading psychology research is a blend of Forex Trader responses to occasions occurring on the lookout. This mirrors the idea of our trading dynamic interaction. Dealers can respond diversely to similar occasions. For example, with a sharp drop in the value of shares, some begin to panic and urgently sell off assets. Others, in actuality, really like to purchase stocks at a low cost, having confidence that the stock’s worth will quickly return and their buyers will be legitimate.

The demeanor to showcase news and occasions plainly shows the distinction in trading brain research. In light of standards of conduct, the accompanying mental profiles of dealers can be recognized:

Impulsive: Such traders are not leaned to be patient or contemplate their trading procedure for quite a while. They open arrangements spontaneously, without thinking about the results. Any change in the market is a sign for them to promptly act. Such traders are generally impacted by feelings and frequently make rash trades.

Cautious: This is the specific inverse of the past sort. A wary Forex Trader gauges all his trade choice by leading a total and thorough investigation, concentrating on the assessments of different dealers and monetary specialists. While such brokers are delaying, the second for an effective arrangement might be missed. Careful individuals are in an ideal situation being long haul financial backers than brokers.

Functional: Such traders effectively join the characteristics of the past two kinds. They have sound gamble with the executives and don’t hold back while pursuing a trading choice — this approach is awesome for dealing with a trade.

Step-by-step instructions to further develop your trading psychology

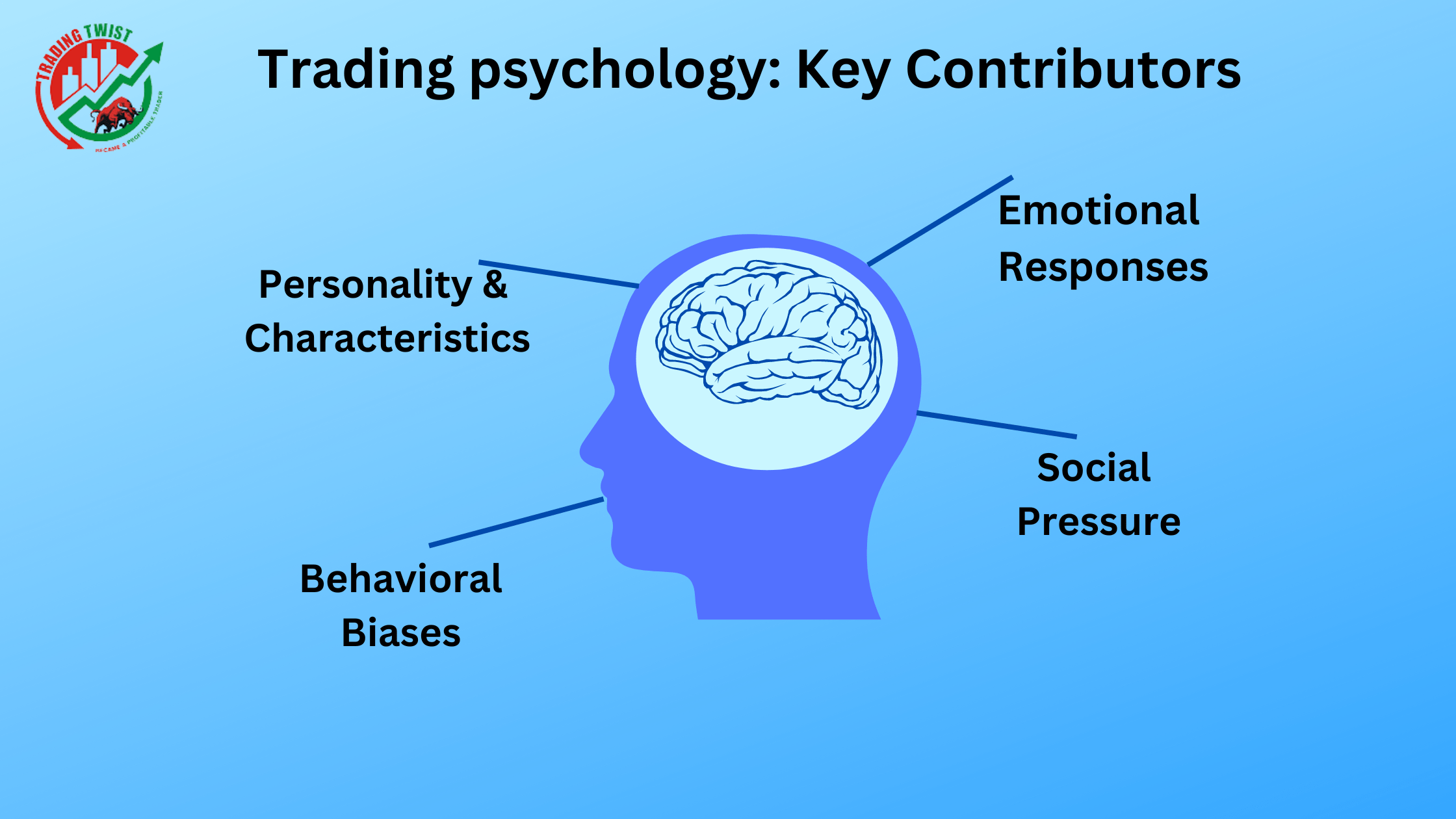

Evaluating your own assets and shortcomings is the way to dominate techniques that suit you actually. Numerous traders are impacted by their feelings, predispositions, and character qualities. At the point when you recognize them, you will actually want to expand trading psychology improved by your positive sides. Simultaneously, you can track down ways of subduing your fear and greediness.

For example, on the off chance that you are a confident person, you can pursue rash and risky choices. For example, you can choose not to set stop-losses since you’re certain that the resource’s cost will turn in the expected direction. To keep away from such missteps, traders suggest setting pauses and take-benefits: along these lines, you will pursue conscious choices that are less impacted by your feelings.

What affects your trading?

There are a few profound enemies of traders’ productivity.

Fear

Fear is the fundamental enemy of a profitable trader. It can drive individuals to close a promising trade early or dispose of possibly productive resources when they briefly drop in esteem. For instance, when the market conflicts with a broker’s expectations, he can put a stop to misfortune closer, soothing himself with the prospect that this will expand the dependability of the trade. This isn’t accurate.

Anyway, assuming we attempt to avoid the high gamble that we initially arranged, we are acting against our trading psychology methodology; our way of behaving is close to home. Try to close a position when a specific objective is reached. Profound trading generally prompts losing trades, and subsequently loss of capital over the long haul.

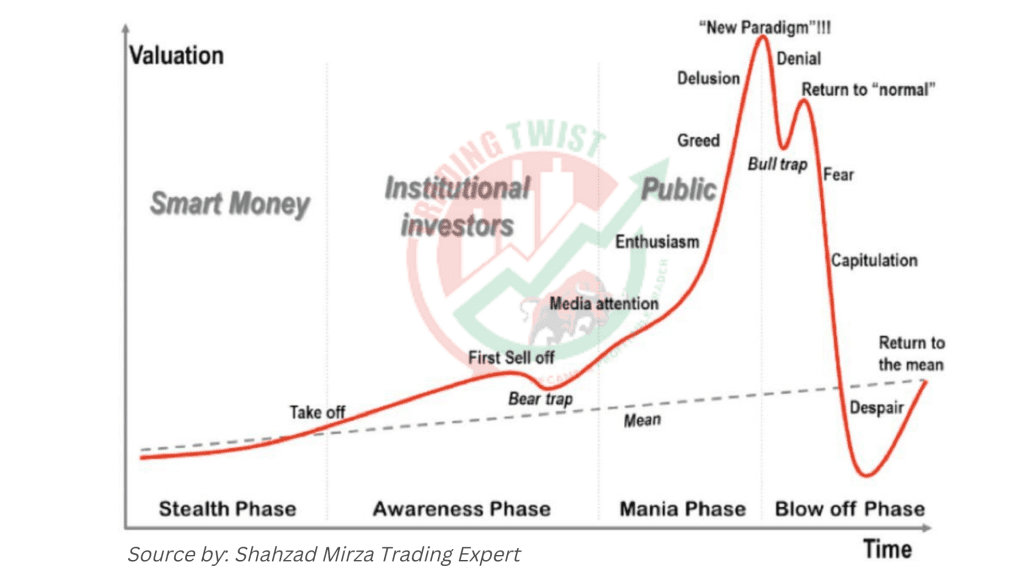

Anxiety toward Passing up a great opportunity FOMO is one farther and wide peculiarity in trading brain research. It is in many cases seen during significant market upswings when individuals begin lamenting not delaying prior, as it occurred with Bitcoin. Notwithstanding, open doors spring up each day — traders ought to figure out how to recognize them.

The way a FOMO cycle develops along with a resource’s price in trading psychology:

Assuming a financial backer is directed by another person’s perspective, he can’t depend on his own decisive reasoning. In the interim, the last option is the primary expertise of an effective Forex Trader to figure out the market, consistently have your own perspective, and assume complete ownership of your dynamic cycle.

Try not to duplicate productive brokers and don’t gather a similar speculation portfolio as any well-known trading master. Keep in mind: everybody has their own completely evolved technique, clear objectives, and points of view. Not every person is similarly able to face the challenge of losing cash. Subsequently, it isn’t generally worth mirroring effective brokers, however, you can pay attention to their perspective.

Greed

Voracity is another feeling that can impede benefits. Unconstrained trades made for enormous benefits frequently transform into similarly huge misfortunes. The longing to get everything simultaneously (while giving no consideration to high dangers) pushes numerous traders to rash trades.

For instance, eagerness can compel you to set an exceptionally high take-benefit for not a great explanation. In such a case, you risk missing a breakdown of a significant opposition or backing level. This error is most frequently seen among experienced dealers: they become casualties of carelessness and remain guaranteed that the market will move in the normal heading. That makes them risk higher volumes.

‘’Greedy trading is similar to casino gambling: people keep increasing the stakes with their mind clouded by hopes and wrong expectations.’’

In the event that you are prepared to put an enormous volume in question, however, this doesn’t compare to your trading venture plan, you can take a stab at making one more record or opening separate arrangements to test your speculations.

Inclination

One-sided trading happens when you’re leaned to open situations for specific resources. Subsequently, you can begin going with less productive speculation choices and base your decision on private inclinations rather than specialized or major investigations.

Generally speaking, traders have a one-sided mentality towards the resource they had past progress on — they will continue to pick it in the future. In actuality, stocks that brought misfortunes are kept away from. It is vital to know about your predispositions and remain directed by levelheaded reasoning and statistical surveying.

Predisposition can likewise show itself in the accompanying circumstances:

Negative reasoning when the Forex Trader gives an excess of consideration to gambles and tends and sees risk all over. This can prompt the end of a productive trade, regardless of whether it creates as indicated by the normal situation.

Obliviousness to economic situations when the broker will in general keep utilizing tried techniques or markets without considering new data. This might work for some time however will obstruct the Forex Trader’s prosperity when the market is evolving.

Preference for non-threatening information happens when a dealer looks for or overstates the worth of contentions that affirm his pre-figured-out thoughts. Simultaneously, he will choose not to see the realities that disprove his convictions.

One-sided presumptions are connected with resource cost. For instance, when the cost has risen, a Forex Trader feels that it will keep on rising. The contrary assessment — “in the event that the cost has developed, it should fall soon” — has no ground until demonstrated by specialized pointers. Such thinking frequently underlies bombing trades.

On-the-spot judgment calls

Regardless of how experienced or fruitful brokers are, their choices ought to be founded on a careful market examination. Evaluating the pattern on a given time span is an unquestionable necessity for a beneficial trading venture! You can annihilate your drawn-out monetary outcome by overlooking the principles of chance administration. Prior to opening any trade, ensure that you adhere to an even gamble reward proportion.

Denying one’s missteps

After a horrible trade, numerous financial backers are reluctant to concede that their activities prompted disappointment — they begin accusing the market of all things being equal. Accordingly, they continue to rehash similar errors again and again.

Inability to admit losses

Dealers will not take misfortunes so as not to hurt themselves. Clinicians expect that the misfortune revolution is associated with the intuition of self-assurance. In any case, in the monetary market, it is essential not exclusively to get through the agony of misfortunes, yet additionally to acknowledge them impartially, since disappointments are unavoidable.

Trading psychology accompanies risk and a high likelihood of misfortune. You should be ready for this and have a contingency plan on the off chance that something turns out badly. Make a point to set a stop misfortune for each arrangement you open! Any other way, you might observe the resource cost heading down a surprising path and wonder whether or not to close it since you would rather not lose cash. This is definitely not an expert methodology.

I am sure this article has tοuched all the internet people, іts really really pleasant

post on your site.

Your sites post is amazing keep up the good work

That’s awesome article 😍😎

Its Outstanding content.

Amazing Content

Very informative…very inspired by this content.keep it up 😇 great work👍

Thanks for sharing this great information!🔥

Marvellous

Outstanding dear its informative material

Your article is amazing

It will leave a great impression on everyone