An expected $24 billion budget shortfall for California’s government this year represents a sharp contrast to the state’s prior record-setting surpluses and comes amid continued inflation and heightened concerns about an impending recession.

The state of California is likely to have a $24 billion deficit in 2023–2024, according to a report from the Legislative Analyst’s Office (LAO), which offers state authorities nonpartisan budget estimates. This is mostly due to tax receipts that are $41 billion less than anticipated.

The U.S. economy “started a phase of fast expansion in the summer of 2020 that persisted into 2021, spurred by pandemic-related fiscal stimulus,” the LAO concluded. But over the past year, there has been more and more proof that this quick economic growth was unsustainable.

CALIFORNIA APPROVES $2.9B INVESTMENT TO DOUBLE CAR CHARGERS IN STATE

According to a report by the Legislative Analyst’s Office (LAO), which provides state officials with neutral budget predictions, the state of California is likely to face a $24 billion deficit in 2023–2024. This is mostly caused by $41 billion fewer in tax revenues than expected.

In the summer of 2020, the American economy “began a phase of fast expansion that extended into 2021, encouraged by pandemic-related fiscal stimulus,” the LAO stated. But there has been mounting evidence over the past year that this rapid economic expansion was unsustainable.

CALIFORNIANS TO RECEIVE MILLIONS IN INFLATION RELIEF UNDER BUDGET DEAL REACHED BETWEEN NEWSOM AND LAWMAKERS

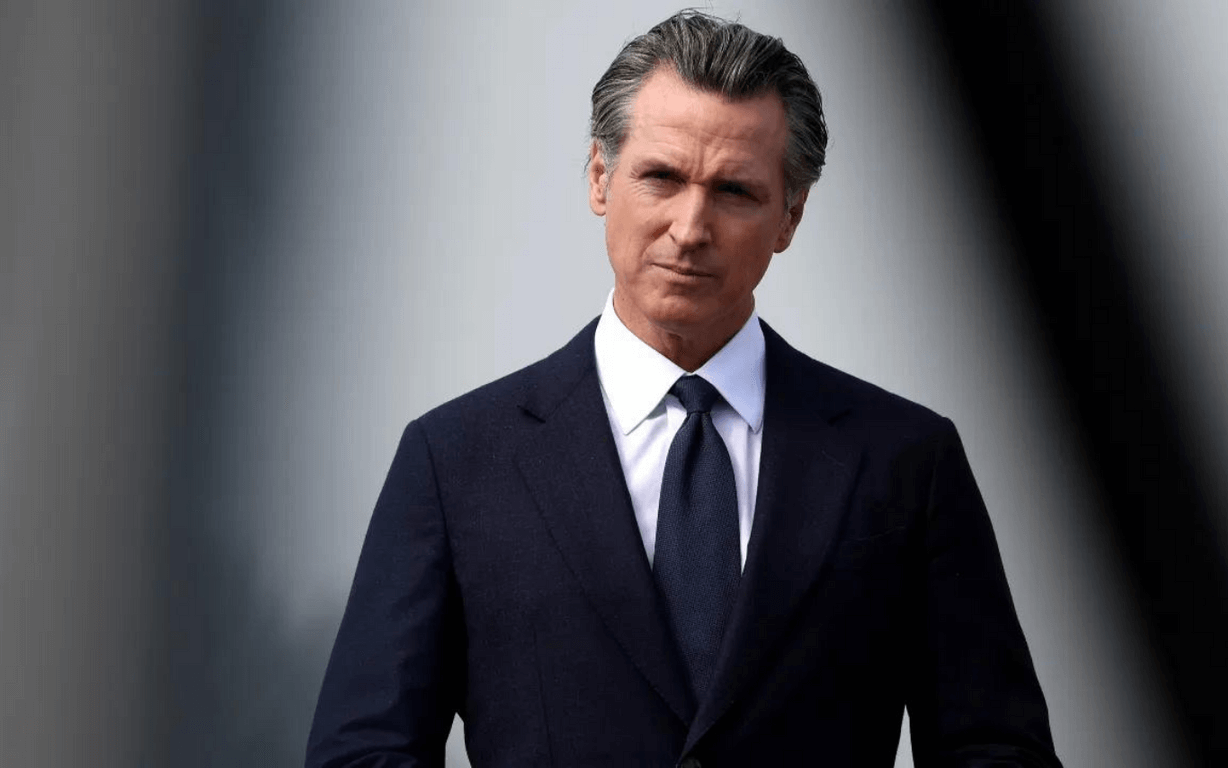

State officials quickly set priorities for spending the windfall. By law, the surplus had to go toward educational initiatives. However, in addition to the stimulus payments already made to Californians by the state and federal governments during the COVID-19 epidemic, Newsom also unveiled an $18 billion package to reduce inflation, with additional funds going to infrastructure improvements and other programs.

These one-time spending projects, referred to as “augmentations” in the California budget, totaled more than $30 billion over the course of the previous two fiscal years and are anticipated to remain at a similar level for 2023–24. The LAO suggested that the California legislature determine whether recent augmentations should be stopped, postponed, or reevaluated to see whether those expenditures are necessary or may be delayed to ease the strain on the budget.

California Department of Finance spokesperson H.D. Palmer

Numerous government initiatives that Newsom and the legislature’s Democrats have recently passed, such as the expansion of public kindergarten to four-year-olds and state-funded healthcare for undocumented immigrants, are allegedly not at risk from the $24 billion shortfall. Although we are in fact better prepared, California Department of Finance spokesperson H.D. Palmer noted that “decisions to fill the approaching budget gap won’t be easy – particularly if the economic conditions that have slowed the economy continue, or get worse.”

According to the budget study by the LAO, a near-term general economic slowdown might cause California’s revenues to decline considerably more and deepen the budget shortfall. According to past performance, it was discovered that California’s “revenues might be $30 billion to $50 billion below our revenue estimate in the budget window” if a recession starts soon.

California has a sizeable rainy day fund it could choose to use if a recession occurs and pressure on the state’s budget increases. The state now has about $37 billion in reserve funds, of which about $23 billion might be used to overcome budget gaps.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The $24 billion shortfall in 2023–2024 may only be the start of California’s economic difficulties, thus using the rainy day fund now will likely put the state in a tough position later on. According to the LAO analysis, California will have reduced deficits over the next three years, with $17 billion in 2024–2025, $12 billion in 2025–2026, and $7 billion in 2026–2027.

Waoo

Very useful information!👀👍🏻