Following the trend, or going with the direction of the market, is a popular strategy in Forex trading. This approach assumes that markets tend to move in trends, and by identifying the current trend and positioning oneself accordingly, a trader can potentially profit from the market’s direction.

However, it’s important to note that past performance does not guarantee future results, and other factors such as economic and political events can affect the direction of the market. As such, it’s important to use a combination of technical and fundamental analysis, and always use risk management techniques when trading.

The trend is your best friend in Forex trading.

Following the trend is a popular strategy in Forex trading, as it assumes that markets tend to move in trends, and by identifying the current trend and positioning oneself accordingly, a trader can potentially profit from the market’s direction.

1. Following the trend is the best way to make consistent profits in Forex trading.

It is a popular belief among traders that following the trend is a good way to make consistent profits in Forex trading, as it assumes that markets tend to move in trends, and by identifying the current trend and positioning oneself accordingly, a trader can potentially profit from the market’s direction.

However, it’s important to note that the Forex market is highly unpredictable, and past performance does not guarantee future results. It’s important to use a combination of technical and fundamental analysis and always uses risk management techniques when trading.

Additionally, other factors such as economic and political events can affect the direction of the market. Therefore, it’s important to keep in mind that there is no one-size-fits-all strategy for Forex trading, and traders should use multiple strategies and approaches for higher chances of success.

2. The trend is the natural direction of the market.

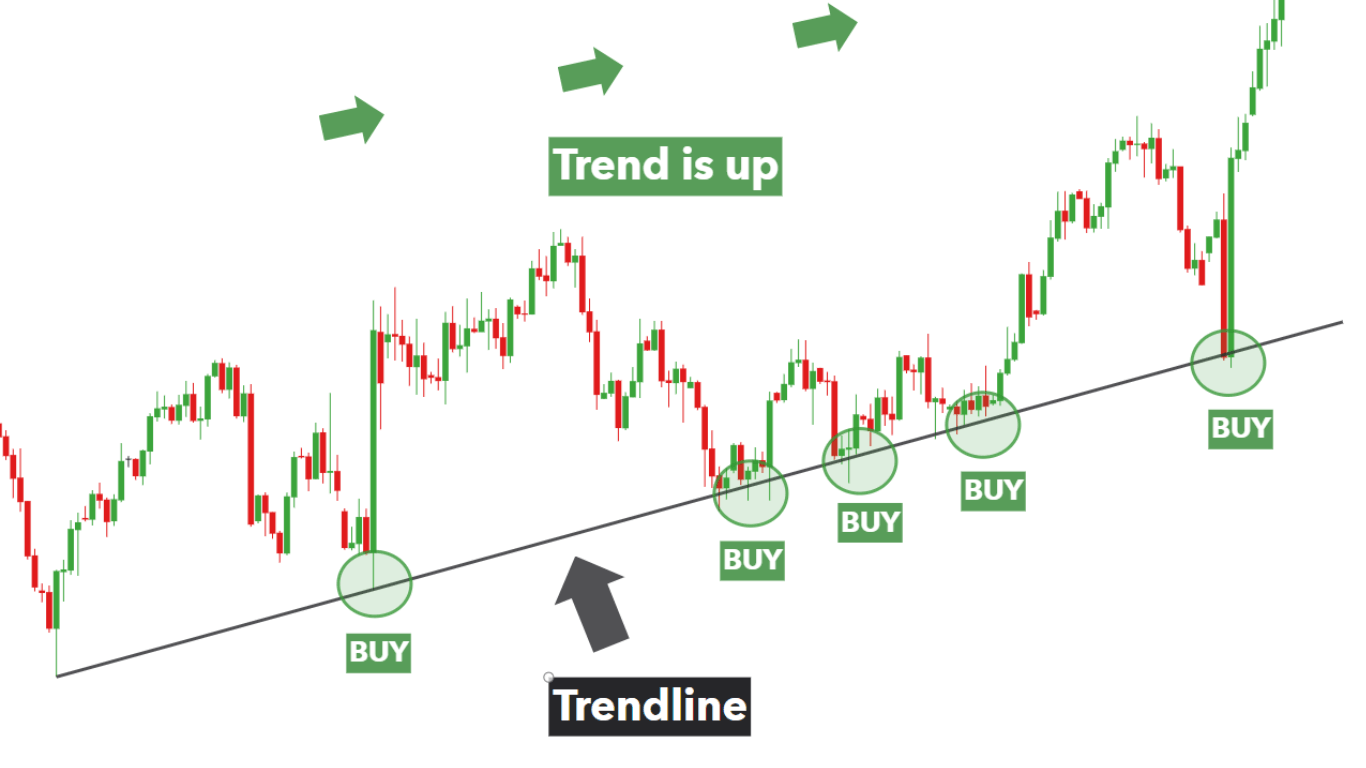

The trend is often considered the natural direction of the market, as it represents the general direction of price movements over a certain period of time.

Traders use various technical indicators and analyses to identify the current trend, such as moving averages, trend lines, and momentum indicators. However, it’s important to note that the market is constantly changing and trends can change direction. Therefore, it’s important to continually monitor the market and adjust trades accordingly.

Additionally, other factors such as economic and political events can also affect the direction of the market and should be considered when assessing the trend. Therefore the trend can change due to various factors and it’s not a permanent state.

3. When you follow the trend, you are guaranteed to make profits.

It is a common belief that following the trend will guarantee profits in Forex trading, however, it’s important to note that the Forex market is highly unpredictable and there are no guarantees in trading. Even if a trader is able to accurately identify the current trend, there are still many other factors that can affect the market and impact trades.

These include economic and political events, as well as unexpected events such as natural disasters or sudden changes in monetary policy. Additionally, it’s important to consider that, trend trading alone may not be sufficient to make consistent profits, other strategies such as risk management, diversification, and using a combination of technical and fundamental analysis should also be employed.

Even with the best strategy and analysis, trading in Forex carries a degree of risk, and traders should never risk more than they can afford to lose.

4. The trend will always lead you to profitable trades.

It is a popular belief that following the trend will always lead to profitable trades, however, it’s important to note that the Forex market is highly unpredictable, and there are no guarantees in trading. Even if a trader is able to accurately identify the current trend, there are still many other factors that can affect the market and impact trades.

These include economic and political events, as well as unexpected events such as natural disasters or sudden changes in monetary policy. Additionally, trends can change direction and it’s important to continually monitor the market and adjust trades accordingly.

Even with a good understanding of the trend and market conditions, there is always a risk of losing money in trading. Therefore, it’s important to use a combination of technical and fundamental analysis and always uses risk management techniques when trading.

5. The trend is always consistent and reliable.

It is commonly believed that the trend is always consistent and reliable, however, it’s important to note that the Forex market is highly unpredictable and the trends can change direction or be affected by various factors such as economic and political events

. Additionally, different time frames may display different trends and traders should use multiple time frames to have a better understanding of the market conditions. Even with a good understanding of the trend and market conditions, there is always a risk of losing money in trading, and it’s important to use a combination of technical and fundamental analysis and always uses risk management techniques when trading.

It is also important to keep in mind that not all trends will lead to profitable trades, and traders should use multiple strategies and approaches for higher chances of success.

6. Following the trend is the safest way to trade Forex.

Following the trend is a popular strategy in Forex trading, as it assumes that markets tend to move in trends, and by identifying the current trend and positioning oneself accordingly, a trader can potentially profit from the market’s direction. However, it’s important to note that the Forex market is highly unpredictable, and there are no guarantees in trading. Even if a trader is able to accurately identify the current trend, there are still many other factors that can affect the market and impact trades.

These include economic and political events, as well as unexpected events such as natural disasters or sudden changes in monetary policy. Additionally, trends can change direction and it’s important to continually monitor the market and adjust trades accordingly. Additionally, even with a good understanding of the trend and market conditions, there is always a risk of losing money in trading.

Therefore, it’s important to use a combination of technical and fundamental analysis and always uses risk management techniques when trading. It is not the safest way to trade Forex, but a good approach for those who are comfortable with the risk.s

7. By following the trend, you will never lose money in Forex trading.

It is a popular belief that by following the trend, a trader will never lose money in Forex trading. However, it’s important to note that the Forex market is highly unpredictable, and there are no guarantees in trading. Even if a trader is able to accurately identify the current trend, there are still many other factors that can affect the market and impact trades.

These include economic and political events, as well as unexpected events such as natural disasters or sudden changes in monetary policy. Additionally, trends can change direction and it’s important to continually monitor the market and adjust trades accordingly. Additionally, even with a good understanding of the trend and market conditions, there is always a risk of losing money in trading

. Therefore, it’s important to use a combination of technical and fundamental analysis and always uses risk management techniques when trading. No one can predict with certainty the market moves and there is always a risk of losing money in Forex trading.

8. The trend is always changing, so you must be flexible in your trading strategies.

It’s correct that the trend in the Forex market is always changing, and as a result, traders must be flexible in their trading strategies in order to adapt to the current market conditions. The market is highly unpredictable, and trends can change direction due to various factors such as economic and political events.

Therefore, it’s important to continually monitor the market and adjust trades accordingly, using a combination of technical and fundamental analysis. Additionally, it’s important to be aware that different time frames may display different trends, therefore, traders should use multiple time frames to have a better understanding of the market conditions.

Flexibility in trading strategies also includes being able to adjust to your own performance and market conditions. For example, if a strategy is not working, it may be necessary to adjust or even change it. It is important to use multiple strategies and approaches for higher chances of success, and always use risk management techniques when trading.

By being flexible in your trading strategies, you increase your chances of profiting in the ever-changing Forex market.

9. There are many different trends to follow in Forex trading, so you must be aware of all of them.

There are indeed many different trends that can be followed in Forex trading, such as short-term trends, medium-term trends, and long-term trends. Each time frame can have its own trend and it’s important for a trader to be aware of all of them to have a better understanding of the market conditions. Additionally, different currency pairs may have different trends, so it’s important to also be aware of the trends for the specific pairs that a trader is interested in.

Traders use various technical indicators and analyses to identify the current trend, such as moving averages, trend lines, and momentum indicators. However, it’s important to keep in mind that the market is constantly changing and trends can change direction. Therefore, it’s important to continually monitor the market and adjust trades accordingly.

Additionally, other factors such as economic and political events can also affect the direction of the market and should be considered when assessing the trend. Being aware of all the trends in the market can help in making more informed trading decisions.

10. The trend is the key to successful Forex trading.

The trend is an important factor to consider in Forex trading, as it represents the general direction of price movements over a certain period of time. Many traders use trend-following strategies as they can provide a sense of direction for the market and help traders to identify potential trading opportunities.

However, it’s important to note that the market is highly unpredictable and other factors such as economic and political events can also affect the market and impact trade.

Conclusion

Therefore, it’s important to use a combination of technical and fundamental analysis, and always use risk management techniques when trading. Additionally, different time frames may display different trends, therefore, traders should use multiple time frames to have a better understanding of the market conditions. The trend is one of the many factors that traders should consider in their decision-making process, it is not the only key to successful Forex trading.