The USD/CHF chart technical outlook provides an analysis of the price action and key technical indicators for the USD/CHF currency pair. The USD/CHF is the abbreviation for the exchange rate between the US dollar and the Swiss franc.

In recent weeks, the USD/CHF pair has been displaying a bearish trend, as the US dollar has been weakening against the Swiss franc. The overall price movement has been characterized by lower highs and lower lows, indicating a downward trend.

Looking at the moving averages, the shorter-term moving average, such as the 50-day moving average, has crossed below the longer-term moving average, like the 200-day moving average. This bearish crossover suggests that the downward momentum may continue in the near term.

Furthermore, the Relative Strength Index (RSI), a momentum oscillator, has been indicating oversold conditions for the USD/CHF pair. This could potentially suggest that a reversal or a temporary bounce may be on the horizon. However, it is important to note that oversold conditions alone are not sufficient to determine a trend reversal, and other technical indicators should be considered.

Key support and resistance levels

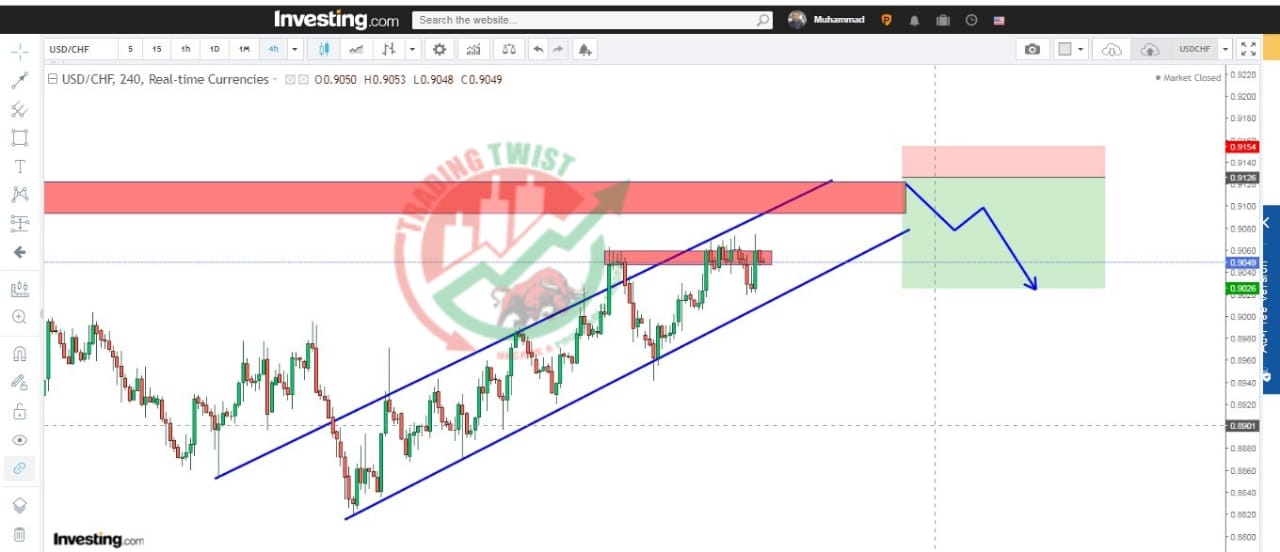

Key support and resistance levels are worth noting on the USD/CHF chart. The recent downward movement has pushed the pair towards a major support level of around 0.8900. If the price breaks below this level, it could open the door for further downside potential towards the next support level around 0.8800.

On the upside, immediate resistance can be observed near the 0.9000 level. A break above this level could signal a potential reversal or a relief rally towards the next resistance level around 0.9100.

Traders and investors should closely monitor the USD/CHF chart and consider other fundamental factors that may impact the exchange rate, such as economic data, monetary policy decisions, and geopolitical events. Technical analysis provides a framework for understanding price movements, but it is important to integrate it with a comprehensive analysis of the broader market context.