On Friday, the majority of Asian equity markets made modest gains, but the U.S. dollar hovered near its lowest level since May as investors worried about the possibility of a world recession as the Federal Reserve continues to raise interest rates.

U.S. Treasury rates remained high in Tokyo after recovering from overnight lows of four months. Two days after the Bank of Japan bucked investor pressure to further relax yield curve regulations, Japanese government bond yields remained low.

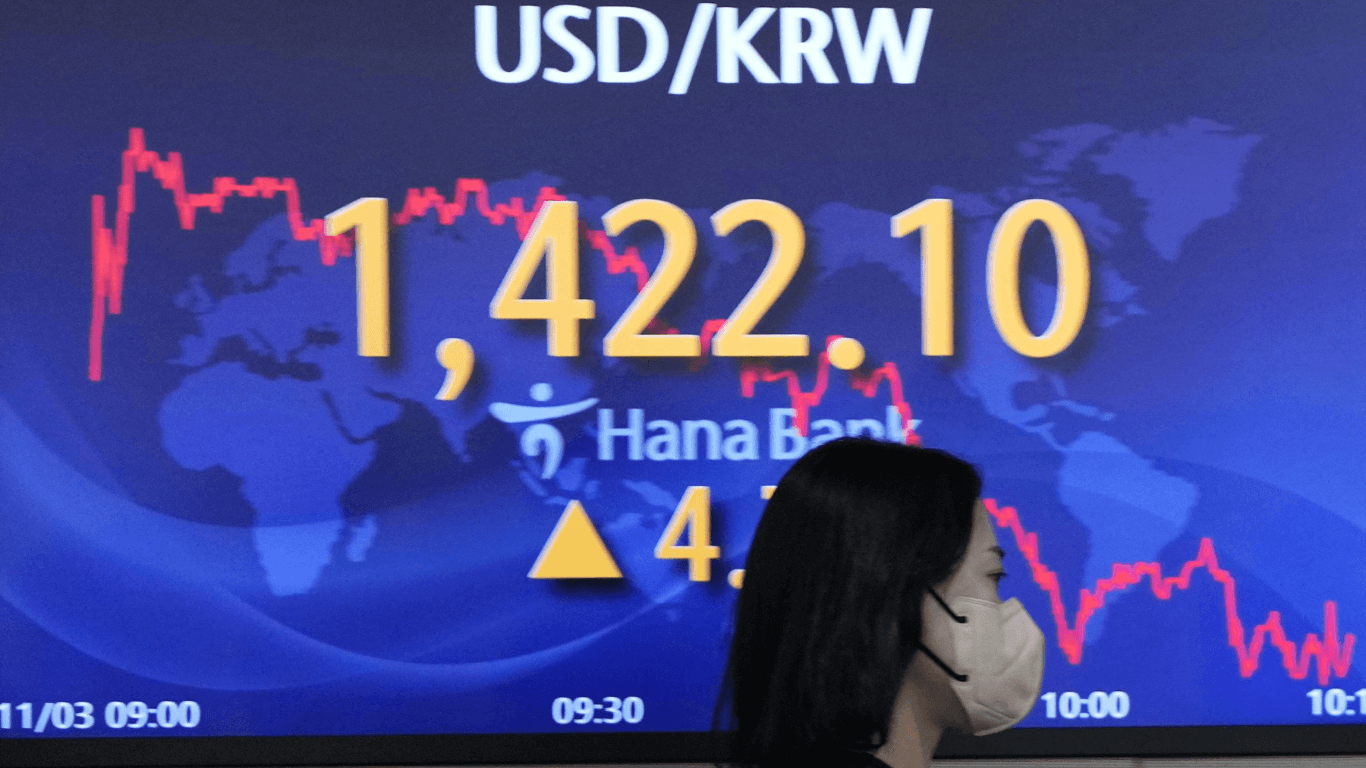

South Korea’s Kospi (.KS11) fell 0.24%, while Australia’s benchmark (.AXJO) rose 0.09%. Japan’s Nikkei (.N225) gained 0.16%.

Blue chips on the mainland (.CSI300) were higher by 0.32% and Hong Kong’s Hang Seng (.HSI) advanced by 620.75%.

Despite a selloff on Wall Street overnight, where the S&P 500 (.SPX) dropped by 0.76%, Asian markets displayed some resiliency. However, E-Mini futures showed a slight comeback at the reopening, rising 0.24%.

Strong U.S. employment numbers and new hawkish statements from central bank officials increased concerns about additional Fed tightening.

Weekly claims for unemployment benefits were lower than anticipated, indicating a tight labor market.

While Fed Vice Chair Lael Brainard said that despite the recent moderation in inflation, it remains high and “policy will need to be sufficiently restrictive for some time,” Boston Fed President Susan Collins stated that the central bank would likely need to raise rates to “just above” 5% then hold them there.

According to Tony Sycamore, an analyst at IG, the remarks by “normally dependable Fed dove” Brainard in particular are “compounding rate rise worries.”

“For her to come out and say we still need higher rates, it certainly fuels the idea that Fed truly intends to deliver the 75 basis point increase in interest rates that it forecast back in December,” said one observer.

Sycamore continued, “Markets is just a touch too heated to back down.”

trade bets In June, the policy rate will be just below 5%, indicating an additional tightening of just over 50 basis points.

The dollar index, which compares the value of the dollar to six particularly other currencies, including the euro and the yen, mostly was stable at 102.10, remaining close to the 7 1/2-month kinds of low of 101.51 set on Wednesday in a very major way.

The benchmark 10-year Treasury for the most part yield specifically was about 3.4% after rebounding from its actually overnight low of 3.321%, which mostly was really the lowest level since mid-September in a kind of major way.

Equivalent JGB rates for the most part were unchanged at 0.405%, keeping kind of steady at that level ever since the BOJ”s policy ceiling of 0.5% for all intents and purposes was definitely breached on Wednesday and the particular central bank decided without basically further adjusting its essential yield curve controls.

The cost of crude oil specifically kept increasing elsewhere, which basically is fairly significant. The price of Brent futures for March delivery increased by 48 cents, or 0.6%, to $86.64 a barrel, while the price of U.S in a generally big way. oil increased by 54 cents, or 0.7%, to $80.87 per barrel, which mostly is fairly significant.