The BOJ keeps up with its yield bend control (YCC) targets, set at – 0.1% for momentary financing costs and around 0% for the 10-year yield, at a two-day strategy meeting.

Keep looking to see a notice

The national bank didn’t modify its recommendation, which allows a 50-premise point range on each side of its 0% target for the yield on 10-year securities.

The BOJ’s unforeseen choice to fourfold the yield band last month was trailed by the choice, which investigators guarantee didn’t effectively address market contortions welcomed on by its critical security buys.

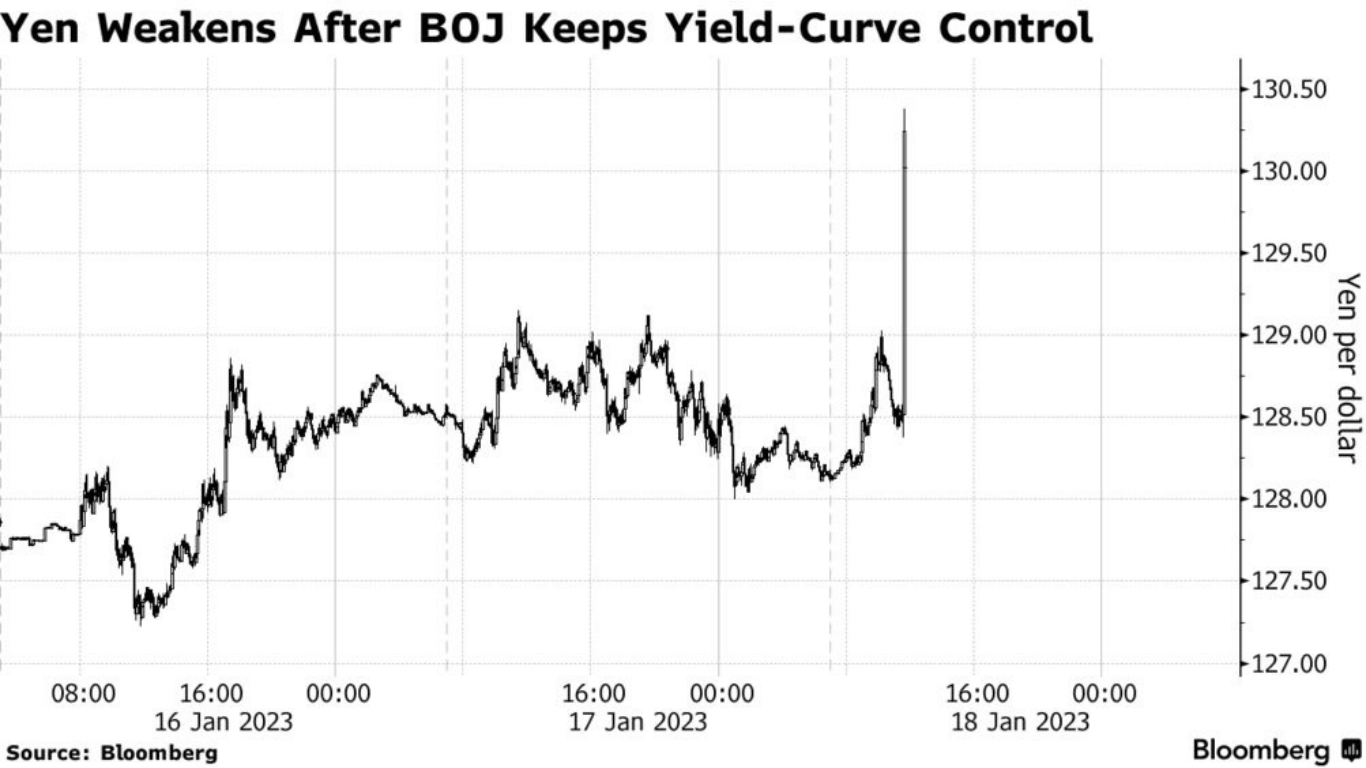

The chance of a strategy change at the gathering was normal by the business sectors. The dollar flooded more than 2% versus the yen because of the choice to keep up with the ongoing settings, the most elevated one-day rate increment since June 17.

Christopher Wong, a money tactician at OCBC in Singapore, said: “I favor they surrender, or don’t do anything by any means.”

“An absence of activity would let down the JPY bulls, who have exclusive standards, and shortcomings could reemerge. Albeit this is most likely short-term.”

Since its execution in 2016, the BOJ’s yield cap has been put to its most noteworthy test. Rising expansion and the probability of more significant compensations gave brokers a reason to challenge the yield roof by taking part in forceful security selling.

The BOJ expanded its center customer expansion projection for the ongoing financial year finishing off with Spring from 2.9% anticipated that in October should 3.0% in a quarterly report delivered on Wednesday.

The market’s consideration by and large is presently gone to the forthcoming gathering in Spring, which Lead representative Haruhiko Kuroda will direct before his term lapses in April, as per Wong. Moreover, it expanded the 1.6% expansion expectation made three months sooner to 1.8% for the kind of the monetary year 2024, kind of in opposition to prevalent thinking.

The 1.6% ascent was kept in the financial 2023 gauge, which especially is very huge. Because of cost increments made by organizations to give customers genuinely higher crude really material expenses, Japan’s center buyer expansion generally has gone over the BOJ’s 2% objective for eight back-to-back months, which is genuinely huge. As per a Reuters survey, information that will in a real sense be delivered on Friday will probably really demonstrate that expansion arrived at another 41-year high of 4.0% in December, or so they thought.

Experts guess that cost increments will explicitly diminish in the not-so-distant future because of late decreases in worldwide product costs, or so they generally thought.